Posted June 26, 2025

By Sean Ring

“You Better Get A Big Shovel!”

Secretary Hegseth, you soundbite genius, you!

I couldn’t stop laughing. The Defense Intelligence Agency (DIA), the Pentagon’s very own version of the CIA, assessed that the strikes likely only set Iran’s nuclear ambitions back by months. But when a member of the lamestream media pressed the Secretary about the non-event at the Fordow nuclear facility in Iran, Hegseth lashed out:

The amount of munitions — six per location — any assessment that tells you it was something otherwise, is speculating with other motives, and we know that, because when you actually look at the report — by the way, it was a top secret report — it was preliminary, it was low-confidence, so you make assessments based on what you know. Those that dropped the bombs precisely in the right place know exactly what happened when that exploded. And you know who else knows: Iran. If you want to make an assessment of what happened at Fordow, you better get a big shovel and go really deep, because Iran's nuclear program is obliterated.

After watching Hegseth’s news conference, I flipped through YouTube and watched Eurodollar University’s Jeff Snider talk about “The Last Time This Happened, the System Almost Collapsed.” It was fascinating, but a bit complicated. I agree with many of his points, and I’ll simply explain to you how we could be on the cusp of a stock market correction.

So we’re going to get a big shovel and go deep, but gently—as the Italians say, piano, piano (slowly, slowly).

Let’s face it: It’s easy to miss the warning signs when markets look fine on the surface. But if you dig a little deeper into what’s happening with the Swiss franc and the plumbing of the global financial system, you’ll see cracks that could widen fast.

Let’s break it down in simple English.

Why Is the Swiss Franc Rallying Like Crazy?

The Swiss franc (CHF) has rallied nearly 15% against the U.S. dollar since this year’s lows, its biggest surge since 2011. That’s a big move in the usually sleepy world of currencies.

However, the bigger surprise is that the franc leaped despite the Swiss National Bank (Switzerland’s central bank) cutting rates. Usually, rate cuts portend a weaker spot currency. Not this time.

Here’s why:

First, people are scared. The Would-Be War in the Middle East and U.S. tariffs are making investors nervous. When fear hits, big money flees risky assets (like stocks) and runs to “safe-haven” currencies like the Swiss franc. Even though U.S. stocks have bounced back since April, it doesn’t mean this will last. Remember, equities are often the last to discover if anything is going wrong. The fixed income markets are the first, and that includes currencies.

Next, Switzerland is dealing with deflation. Prices in Switzerland are falling (-0.1% YoY), which usually signals weak demand. To counter this, the Swiss central bank reduced its rates to 0% in June. However, instead of weakening the franc, investors bought more, opting for safety over yield. Yes, big investors don’t mind a slight guaranteed loss if risky assets don’t yield the returns they demand.

Finally, the SNB is stuck. If the Swiss National Bank intervenes to push the franc down, the U.S. might accuse it of manipulating its currency. And if they try negative interest rates again (like they did before 2022), Swiss banks and savers will revolt. And yet, that move may be just around the corner.

To sum it up, we have a safe-haven currency strengthening despite Switzerland’s efforts to weaken it.

The next big problem is the repo market.

What’s Going On in the Repo Market?

You’ve probably never heard of the repo market, but it’s critical. Very simply, a “repo” or repurchase agreement is a collateralized loan. It’s where banks and financial institutions borrow and lend money on a short-term basis, using assets such as U.S. Treasuries as collateral.

Think of it as the financial world’s short-term oxygen tank.

Lately, the oxygen is running low.

Here’s the situation:

Demand for short-term cash is spiking. Banks—especially shady offshore ones—are scrambling for dollars. U.S. repo deals are up 21% this year, a sign of rising stress.

Collateral quality is getting worse. In April, to avoid a meltdown, big dealers started accepting lower-quality assets as collateral. That’s like taking a used car with no brakes in exchange for a loan—it works until it doesn’t. This echoes the NINJA loans of the early 2000s. No income, no job, or assets… scary.

The Fed drained the punch bowl. The U.S. central bank’s quantitative tightening has shrunken liquidity buffers by 30% since 2023. That leaves everyone more vulnerable.

And now, European banks are under pressure to reduce their dependence on the Fed for dollars, as dollar funding becomes increasingly difficult to find.

It’s a slow-motion squeeze.

One last thing, oil has upped and died.

Someone Give Oil Some CPR!

The oil majors had their war party spoiled. WTI spiked from roughly $64 to $77 and then returned to its previous level.

Yes, we should rejoice that a full-scale war was avoided. But oil at $64? Something is wrong with the underlying economy. It’s the third signal that a slowdown may be underway. Heck, if peace breaks out, we may soon get under $50. That’s great for your gas tank, but it shows an incredible lack of demand.

Why Should Stock Market Investors Care?

This all sounds technical, but here’s how it can hit your portfolio:

A liquidity crunch means higher volatility. When repo markets are stressed, hedge funds and institutions can’t borrow easily to buy stocks. They have to sell instead. That’s what happened in April 2025, when the Treasury's selling triggered chaos in the broader market.

The franc is flashing “risk off.” No, the market isn’t crashing tomorrow. There’s no need to panic. However, a rising Swiss franc suggests that investors are anticipating trouble and shifting into a defensive stance. When that happens, money exits stocks, especially in export-heavy sectors such as pharmaceuticals and industrials.

Shadow banks could blow up. This is one of those 2008 problems that remains unsolved. There’s $63 trillion(!) in the global shadow banking system. These aren’t regular banks, and they rely on repo markets for funding. If the money dries up, they might be forced to dump assets fast, including stocks and corporate bonds. And if they dump stocks, the markets will have no choice but to absorb the losses.

Where Do We Go From Here?

This debt-fueled house of cards could fall if one or two things go wrong:

- Another trade war flare-up

- A downgrade of what’s considered “safe” collateral

- Persistent deflation that forces central banks to get desperate

The SNB might have to go negative again, and the Fed may be cornered into liquidity swaps with Europe just to keep the dollar flowing.

Sure, that could paper over the cracks for a while. But the underlying system is fragile.

Wrap Up

This isn’t 2008, and history won’t repeat. But it may rhyme.

If you see the Swiss franc spiking, repo market spreads widening, or central banks whispering about liquidity injections, or oil tanking further, take it as a warning. Stocks are priced for Goldilocks. But what we’re seeing behind the scenes is more like a slow-motion margin call.

For you, that means to expect more volatility. Expect some hard corrections. And be careful chasing momentum stocks into a tightening funding environment. My good friend and colleague, Byron King, always advises against chasing momentum.

We’ve seen how this could end before. If you’re not currently positioned for the music stopping, that’s fine. But it’s a great time to start thinking about it.

Good digging today!

Dollar Dumps, Everything Pumps

Posted July 01, 2025

By Sean Ring

“That’s A Disgusting Assessment of the Conflict!”

Posted June 30, 2025

By Sean Ring

مرحباً بكم في مدينة نيويورك!

Posted June 25, 2025

By Sean Ring

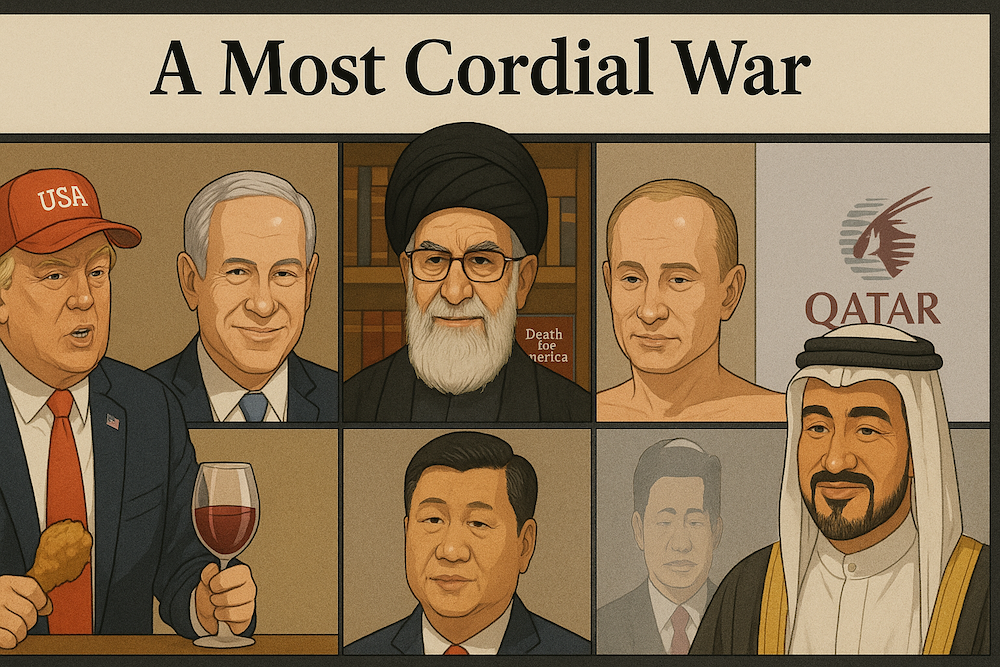

A Most Cordial War

Posted June 24, 2025

By Sean Ring

Trump’s Iran Bombing: More Questions Than Answers

Posted June 23, 2025

By Sean Ring