Posted September 05, 2025

By Byron King

X Marks the Stocks

First, let’s discuss pirate movies. Then, we’ll discuss how to make money in gold mining plays. In this article for the Rude Awakening, I’m going to connect these two ideas.

Think back over the past 20 years or so. You may have seen one or more of the five Disney productions in the Pirates of the Caribbean franchise, starring Johnny Depp and other notable actors. The films performed well at the box office, demonstrating broad audience appeal.

Pirates of the Caribbean poster. Courtesy Disney Corp.

Pirates of the Caribbean poster. Courtesy Disney Corp.

Or maybe, looking back further in life, you watched old pirate films from… well, since the beginning of moviemaking. In fact (and this is pure trivia), the first known “pirate” movie was a silent film in 1903.

In other words, since the dawn of the silver screen, studios have turned out pirate-themed films. A quick search reveals over twenty cinematic versions of just Treasure Island, based on the book of the same name by Robert Louis Stevenson. And if you surf name lists and plot lines of old movies, you’ll find many others in the pirate genre.

By definition, pirate movies are action movies, and when done right, they’re enjoyable and even thought-provoking. That is, with salty sailors and sailing ships surging upon stormy seas, you have a “man versus nature” theme. And with pirates shooting it out or swinging their gleaming cutlasses, you have that “man versus man” angle.

It is also worth noting that one central theme in pirate tales is the search for treasure, particularly the pursuit of secret caches of gold and silver hidden on deserted islands. The loot is out there, just waiting to be found by swashbuckling adventurers and fortune hunters. Because everybody loves to find loot and gain a fortune, right?

With this in mind, I’ll lay out three “buried treasure sites” for you, so to speak. And the prize – the proverbial “X” on the map – is a serious amount of gold, as well as silver, copper, and other valuable metals and minerals.

But don’t worry, I’ll spare all the pirate movie drama and suspense and just come out and tell you where the gold is buried. I’ll show you exactly where to look, and you’ll probably be glad to know that the sites are all on terra firma here in North America, not on distant islands.

Plus, to make it easier, you can buy shares in companies that are doing the field work, so you won’t have to go to sea on a ship and duke it out with rivals like the late, great pirate (and decorated World War II Navy commando) Douglas Fairbanks, Jr.

Swashbuckling Douglas Fairbanks, Jr., Courtesy Paramount Pictures.

Swashbuckling Douglas Fairbanks, Jr., Courtesy Paramount Pictures.

Explore-Develop-Produce

Let’s review a few basics for anyone who may be new to the arena of mines and minerals.

Begin with Gold 101, so to speak; a solid gold nugget that a very fortunate fellow fished from a stream in central Alaska. I saw this one at the Alaska Mint in Anchorage on a recent trip.

Gold nugget from Alaska, at Alaska Mint, Anchorage. BWK photo.

Gold nugget from Alaska, at Alaska Mint, Anchorage. BWK photo.

Absolutely, this gorgeous hunk is a rare find. However, it also illustrates successful prospecting, the so-called “eureka” moment that has captured people’s emotions since time immemorial (and certainly, pirates of old).

Over geologic time, this nugget formed within a massive rock body and was subsequently weathered out, likely during the last glacial cycle. Gravity pulled it downhill into a stream, where it was transported and rounded off by a combination of moving water and shifting gravel. And to make a long story short, some Lucky Pierre found it.

But the discovery/production process I just described is not how most gold is produced these days. Indeed, sluicing through streambed gravel (called “placer mining”) is an industrial sideshow in the big scheme of things in the gold-finding biz. Most of the world’s gold output comes from large mines like this one in Nevada.

Open pit gold mine. Courtesy NorthernMiner.com.

Open pit gold mine. Courtesy NorthernMiner.com.

As you can see, much modern gold mining involves digging big holes in the ground and moving a lot of rock. And this only occurs after spending immense up-front money to acquire exploration rights, followed by permits, mapping, geophysics, additional permits, sampling and drilling, chemical assays, and further permits. The process involves numerous specialists from various fields, including aircraft or helicopter operations, road construction, water diversions, power lines, and many more.

In short, the early phases of gold exploration involve investing substantial capital, typically in the range of hundreds of millions of dollars, even for relatively modest resource quantities. And this gets spent long before the first ounce of metal comes out of the ground. In other words, first you must find some gold and identify an ore body, but any way you cut things, it involves big bucks.

I won’t get deep into the overall exploration process. But you ought to understand how exploration takes people and projects from the beginning of a prospect to a point where there’s enough data to convince other investors (aka, people with money) that there’s an ore body in the ground, and that it’s worth the energy and resources (and their money) to develop.

So, what comes next? Well, it’s called “development,” but that’s a broad term that involves investing further hundreds of millions, if not billions, of dollars; and yes, these things are expensive. In general, development takes the initial data from exploration and advances that knowledge base and engineering through a buildout process, toward the goal of creating a production project, aka “a mine.”

However, this exploration-development-production dynamic is more of a fuzzy spectrum than a hard list of well-defined milestones. For example, in some cases, basic exploration work requires a significant amount of development, including tasks such as road building, channeling water, stringing power lines, or creating a campsite with barracks to house workers.

Indeed, I’ve seen projects where so-called exploration involved digging actual mine tunnels and removing rock and ore in bulk samples. Yes, the company was “mining,” after a fashion, but doing it just to test the overall practicality of the project; it was mining-but-not-mining if that makes sense.

Another way to look at development is that the company is spending money to build things like roads and power lines, rather than (yet) digging out ore, processing rock, separating minerals, and extracting concentrates or metals. The company is pre-revenue when it comes to output, and it’s a money sink.

In all cases, achieving production and creating an up-and-running mine requires significant up-front expense, namely those hundreds of millions or billions of dollars I mentioned earlier. Then, finally, the project gets to a production stage, with cash flow, profits, and dividends.

Production involves a workforce at the site, moving rock and ore, and hauling it to a mill for further processing, which turns it into saleable material. With gold, the idea with many projects is to obtain what’s called “gold dore” (an unrefined form of raw gold that often contains silver, copper, and perhaps other metals). Or perhaps the gold is embedded in other minerals that must be isolated and concentrated for further processing.

One way or another, creating a gold mine is a complex and expensive process. It’s a long walk from that original brown stain on a hillside to a cash-generating mine.

Riding the Lassonde Curve

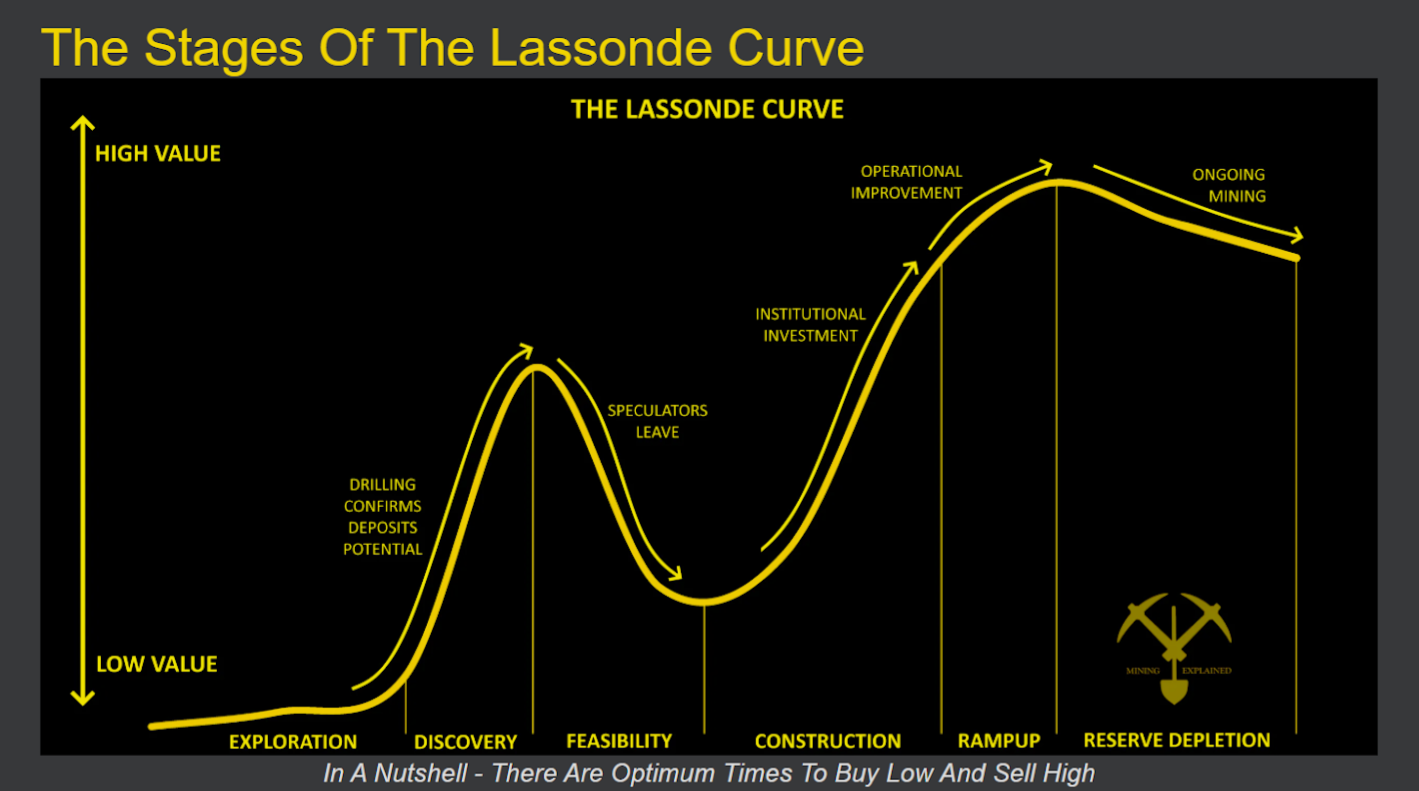

With all of this in mind, let’s examine a graph created by Pierre Lassonde, a legendary Canadian businessman, whose notable success story is Franco Nevada Corp. (FNV), a royalty company with a market capitalization of over $37 billion. (As in, yes, Pierre knows a few things…)

Lassonde Curve. Courtesy MiningExplained.com.

Lassonde Curve. Courtesy MiningExplained.com.

People write books about this, but I’ll keep it brief. Basically, an exploration play begins as a low value stock play while geologists do their initial work. Maybe they’ll find something out in the boondocks, or maybe not. But as good news rolls in, with more and better geological data, the share price typically rises. Discovery feeds the market sentiment for shares. It creates interest.

Later, though, as the euphoria of discovery fades, it’s still necessary to take things to the next level, meaning that the exploration company must now raise and spend money on development. In the Lassonde graph, it is referred to as “feasibility” and “construction.” And this is when the share price tends to fall, as early investors take their money back off the table.

However, note that as a project moves ahead toward “ramp-up” and production, the share price makes another move upwards, and once again there’s money to be made. Which brings us back to those pirate “treasure maps” I discussed above, of which I have three for you…

Three “Xs” With Buried Treasure

Below, I’ll provide you with the names and basic information on three companies that are well past exploration and into development or early production at present. In other words, they’re on the downside of that Lassonde Curve. But in all three cases, they are making progress towards a buildout and are headed towards production.

All three companies are “developers” and two are pre-revenue. Every day, they spend money and do not ring the cash register, or it doesn’t ring too loudly. But consider the current environment for gold, with what appears to be a firm price floor underneath and upside ahead. In this sense, all three companies currently sit on superb resources in the ground, meaning buried treasure from the pirate analogy above. And looking ahead, every time the price of gold, silver, copper, etc. rises, their buried treasure becomes more valuable. It’s the perfect environment for these companies as the gold bull market continues.

Equinox Gold Corp. (EQX):

Equinox runs gold development and production operations in Canada, the U.S., Nicaragua and Brazil. Shares trade in the range of $8.25, giving the company a market cap of $6.2 billion.

Formed by legendary mining entrepreneur Ross Beatty, Equinox is currently at a pivotal moment in its evolution into a top-quartile gold producer. Following its recent merger with Calibre Mining in June, the company now controls a diversified portfolio weighted heavily to Canada and the United States, with more than 65% of net asset value tied to assets in Tier 1 jurisdictions.

The centerpiece of Equinox is two new long-life Canadian mines, Greenstone in Ontario and Valentine in Newfoundland, which will position the company as Canada’s second-largest gold producer once both are fully ramped.

Greenstone has already transitioned into operation and is forecasting 220,000 to 260,000 ounces of output in 2025 at all-in sustaining costs (AISC) of $1,700 to $1,800 per ounce. With 5.7 million ounces of reserves and a 15-year mine life, it sits on the upward slope of the Lassonde Curve; meaning that it’s entering the cash flow growth phase. Valentine, with 2.7 million ounces in reserves and a 14-year mine life, is expected to pour first gold by the end of the third quarter, 2025. Currently in the Lassonde Curve’s development trough, it is set to move sharply higher as it enters production.

Beyond these cornerstone assets, Equinox management projects over 1 million ounces of annual gold production in 2026 at an AISC of $1,525 per ounce, with significant free cash flow growth earmarked for debt reduction and shareholder returns within 18 to 24 months. Trading at just 0.59x consensus NAV, well below peers, EQX represents a rare combination of growth, jurisdictional safety, and valuation upside at a critical inflection point.

Osisko Development Corp. (ODV):

Osisko has an exploration-development project located in the Cariboo region of British Columbia (BC). The company’s shares trade in the range of $2.80, which makes for a market cap of $665 million.

Osisko was put together by another Canadian mining expert, Sean Roosen, who can boast of many past business successes as well; most notably, he developed a mine in Quebec called Canadian Malartic, the largest gold mine in Canada, which he sold off and is now a jewel in the crown of Agnico Eagle Mines (AEM).

Sean’s current focus with Osisko is gold-bearing zones in and around the historic old Barkerville region, which was Canada’s mid-19th-century version of the California Gold Rush.

The Barkerville-Cariboo region has a strong geologic endowment of gold-bearing zones and ore bodies. Plus, it’s crisscrossed by roads and power lines, with plenty of population density and mining heritage to build and retain a solid workforce.

Right now, Osisko holds a vast land package for exploration and development, and the company advertises over 4 million ounces of gold resource. But there’s more yet to come based on a continuous exploration and development drilling program. In fact, some areas under Osisko's control already have test mines and advanced preliminary work. And Osisko has over $200 million of credit facility to pay for additional development.

Recently, I had a long talk with Sean, who told me that his company is building the Cariboo mine at a strong clip, with no significant glitches. He expects to be in gold production in about 12 months. And meanwhile, whenever the price of gold rises the value of Osisko’s buried treasure increases apace.

To be complete, I should mention that Osisko has two other promising gold-copper plays, one in Utah and the other in Sonora, Mexico. Both of these projects show great promise as well and make for extra gravy on the main course in BC.

Seabridge Gold, Inc. (SA):

Seabridge holds a significant, advanced-stage development project located in northwest BC; plus other high-quality assets in BC, the Yukon, Northwest Territories and Nevada. The company’s shares trade in the range of $16.50, which makes for a market cap of $1.6 billion.

Seabridge was put together by an American mining engineer, Rudi Fronk, who has built a superb career in the mining industry, and is held in highest esteem by his peers. He has worked tirelessly for over 25 years on this Seabridge effort, with much to show. And from all appearances, the program is about to break out to the upside with one of the best gold-copper plays anywhere in North America, if not the world, namely a site called KSM (Kerr-Sulphurets-Mitchell) in BC.

In short, KSM is nothing less than astounding. It’s among the world's largest undeveloped gold projects as measured by reserves and resources. A recent Preliminary Feasibility Study (PFS) offers an estimate of proven and probable reserves at 47.3 million ounces of gold and 7.3 billion pounds of copper. Yes, just those numbers alone are staggering.

Seabridge has performed extensive geologic work to identify the minerals and ore zones. Plus, the company put serious money into roadbuilding, bridges, access, and along the way has secured power contracts for electricity necessary to run the project. And Seabridge has strong relations with local First Nations in the region, which is critical and necessary for any development to proceed.

Recently, Rudi spoke confidently about developments that are on the calendar this fall, to include updated technical information, grants of permits, and the possibility of a major agreement with another player in the mine and mineral space. Of course, nothing happens until it happens, but the stars are aligning to the upside for Seabridge.

As with the other two companies I named above, every time the price of gold, silver, copper, and more rises, the value of Seabridge’s buried treasure rises.

Wrap Up

Just to restate, two of these three names are “development” companies; one is in production but also very much a developer on the upside of that Lassonde Curve. Development means that the companies spend money, but do not yet mine ore or show cash flow from operations. But that’s okay because they control significant acreage and mineral rights and have a demonstrated book of value in terms of defined resources in the ground. In this sense, every time the price of gold, silver, etc. rises, the value of these companies’ resources lifts as well.

Meanwhile, all three companies are positioned at the low end of the Lassonde Curve and are heading into the upswing as development/production gains traction and they approach financial milestones.

These names are not included in the official portfolio, but I follow them and stay informed about their developments. If you buy shares, I recommend a spread; that is, buy one-third of a position in each company and be prepared to be patient. Recent share price levels have been relatively stable, but watch the charts, wait for down days, always use limit orders, and never chase momentum.

Again, all three companies are cashed up. They spend internal funds, and I don’t expect them to go out and dilute shareholders. Meanwhile, their underlying value rises as metal prices rise. As companies move through the development cycle into production, expect more share buying by larger players who want to get in before cash begins to flow.

As mentioned elsewhere in this issue, the time to buy gold is now. The gold miners I mentioned above are great investment opportunities as gold prices continue to reach all-time highs.

That’s all for now. Thank you for subscribing and reading.

The Ghost of Louis XVI Warns Trump

Posted September 16, 2025

By Sean Ring

Something like 1980 is about to happen…

Posted September 15, 2025

By Sean Ring

The Curious Incident of the Dog in the Night-Time

Posted September 12, 2025

By Sean Ring

America’s Rubicon: Two Murders That Changed Everything

Posted September 11, 2025

By Sean Ring

Just a Tad… The BLS’s 911k Emergency

Posted September 10, 2025

By Sean Ring