Posted April 28, 2025

By Sean Ring

Volatility: The Secret Weapon of the Smartest Traders

Before I get to today’s topic, I want to shout out to Joe G and his fantastic father for driving from Savannah to Jekyll Island to see the Paradigm crew after we filmed last week’s livestream, The Final Secret of Jekyll Island. Honestly, I had stayed out so late the night before that I was asleep on my feet by the time Joe and his dad arrived. Next time, Joe, we’ll do far more than one round together!

Onto today’s business…

The Rude mailbag brought in a fantastic question from Andrew R. — a question that a lot of investors, even seasoned ones, often wrestle with:

I have been at this investment thing with the stable of Paradigm analysts by my side since early ’23. I have read many of the publications about various investment techniques and learned quite a bit. One thing, however, that continues to elude my firm grasp is volatility. It can’t simply mean the number of transactions per day… can it? Will you explain volatility and why it has (and what sort of) effect it has on options pricing? Why are prices higher for high volatility contracts and vice versa? And should we want to purchase high volatility contracts? I have purchased inexpensive, low-volatility contracts that never seemed to move except gradually against me. Should I have looked for (and if so, HOW?) equities that have more action, even if I pay more for them?

Let’s dive in. However, be aware that I will explain this without using any mathematics or financial theory. If you have any follow-up questions, write to feedback@rudeawakening.com. Thanks!

What Is Volatility?

No, Andrew, volatility doesn’t simply mean the number of transactions per day. That’s volume, and many people make that mistake when starting. You’ve shown great instinct to question that.

Volatility refers to how much the price of an asset moves — and how wildly it moves — over time. Technically, it’s the standard deviation of returns around an average price. But in plain English, higher volatility means bigger price swings (up and down). Lower volatility means smaller, less pronounced price movements.

For example:

- A stock that regularly moves 5% up or down every day is highly volatile. (Think tech stocks, like TSLA.)

- A stock that barely moves 0.2% each day is considered to have low volatility. (Think high dividend-paying old companies like JNJ… yawn!)

Volatility measures movement, not direction. A highly volatile stock can still trend down — it just does so with fireworks along the way.

Why Volatility Matters for Options Pricing

Now, onto the second part: why does volatility affect options prices?

Options are a bet on movement. If you buy a call option, you’re betting the stock will rise above the strike price. If you buy a put, you’re betting the stock will fall below the strike.

The more volatile a stock, the more likely it is that either of those bets could pay off, because there’s more movement. Think of it like this:

- In a calm, low-volatility environment, there’s a slight chance the stock will move enough for your option to become profitable. So the option is cheap.

- In a wild, high-volatility environment, the probability is much higher that your option could move in-the-money. So the option is expensive.

This is why options prices, also called "premiums," are higher when volatility is high, because the odds of a big payoff increase.

Professional options traders break volatility into two types:

- Historical volatility (how much it’s has moved in the past)

- Implied volatility (how much the market expects it to move in the future — this one is baked into the option’s price)

Should You Buy High-Volatility Contracts?

Here’s where it gets a little trickier.

You don’t necessarily always want to buy high-volatility contracts, because high volatility makes the price of the option higher, meaning you need a bigger move just to break even.

In your case, you mentioned you bought inexpensive, low-volatility options, and they just drifted against you slowly. That’s frustrating, but it makes sense. Low volatility means low movement. The option was inexpensive because the odds of making a profit were low.

If you want action, you need movement. This is why traders often resemble gamblers and get paid very well for it.

Higher-volatility stocks can give you movement, but you’ll also pay up for the chance.

The trick is to find the sweet spot:

- Stocks or situations where the market might be underestimating the coming volatility.

- Or, in cases where volatility is expected to rise, such as before earnings reports or major news.

How to Find High-Volatility Opportunities

You asked how to find them — good question.

Most trading platforms have a metric called “Implied Volatility” (IV). You can scan for stocks or ETFs with:

- High current IV

- OR a big difference between Historical Volatility and Implied Volatility (suggesting traders are expecting bigger moves soon)

It’s essential to note that many options traders scan for high implied volatility (IV) to sell those contracts, anticipating a decline in their value. You’re competing against those people’s view.

You can also look for catalysts: earnings announcements, product launches, regulatory approvals, legal battles — any event that could cause a stock to jump or dive.

If you want faster-moving options, look for stocks with higher historical volatility and/or upcoming events. But be prepared to pay a higher premium and accept a higher level of risk.

Wrap Up

Volatility isn’t good or bad — it’s just energy. You want to harness it, not get steamrolled by it.

You’re already ahead of 90% of investors simply by asking these questions, Andrew.

Continue to sharpen your understanding of volatility and option pricing. With time, you’ll find the right balance between risk, movement, and cost that fits your trading style.

In the meantime, follow my colleague and Paradigm Press options trading expert, Alan Knuckman. He talks options all day, every day.

Thanks again for writing in — and keep the questions coming!

❤️🔥HOLY SMOKE! An American Pope!

Posted May 09, 2025

By Sean Ring

The Age of Hephaestus Has Begun

Posted May 08, 2025

By Sean Ring

Fed’s “Stealth” QE Pushed Gold Above $3,400

Posted May 07, 2025

By Sean Ring

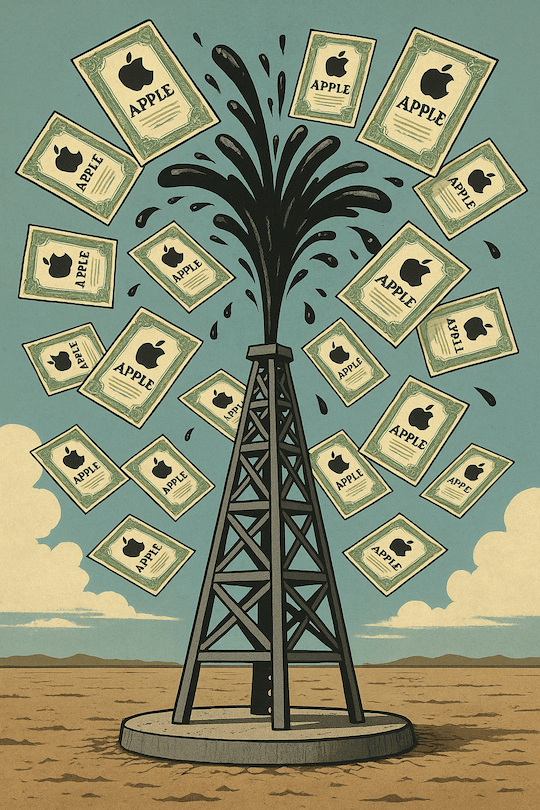

Turning Oil Into Apple

Posted May 06, 2025

By Sean Ring

Goodbye to the GOAT

Posted May 05, 2025

By Sean Ring