Posted May 01, 2024

By Sean Ring

Time For a Breather

April 2024 Monthly Asset Class Report

We ended April with a stinker of a day. Everything was down over 1%.

That’s made the charts look much worse than they did on Friday.

Stocks took a hit, but I’m not ready to call time on this rally… yet. I think we’ve got far more upside to go.

Bonds are performing terribly in this inflationary environment, except for junk. That’s because junk bonds have equity characteristics.

Crypto got taken out back behind the woodshed this month. Only Monero suffered single-digit losses, while the rest were nursing double-digit drawdowns.

Despite the last two weeks of losses, the one bright spot is metals, especially gold, silver, and copper, which performed well in April.

Gold closed at another monthly all-time high despite the sell-off, while silver touched the $28 level before retreating. Copper has rallied hard, though I’m not sure that will last.

Future price action depends on what the Fed does in the coming months. On CNBC yesterday, noted financial commentator and author James Grant said the Fed has as much of a chance of raising rates as cutting them.

I agree with him in principle. But since there are no principles when it comes to politicians bribing the electorate before an election, I’m leaning heavily toward a cut or two despite the fact that it makes zero economic sense to me.

We need a bit of pain, but democracies are notably pain-averse, and their politicians are unlikely to dole it out voluntarily.

With that said, let’s get to the charts.

S&P 500

From two months ago:

Looking at this chart, there’s no reason in the world to be short.

We may take a breather in the coming weeks, but I’d still participate in this rally.

The long-term target remains 6,000.

With all the fiscal stimulus coming through and despite the Fed not cutting rates anytime soon, I’m still long here. This is the breather we needed as we head down the election-year homestretch.

Nasdaq Composite

Same, same, but different, as they say in Asia.

I don’t think this rally is done.

There are too many goodies to be had by politicians bribing voters this November. Hang in there.

Russell 2000 (Small caps)

The Russell 2000 has shown remarkable resistance in the face of this wave of selling.

This 195 level looks like it went from resistance to support.

Whatever you think of Joke Biden’s policies, the end isn’t nigh… yet.

The US 10-Year Yield

It is still in ascendency. This should put pressure on stocks, metals, and crypto, and it has. Of course, this also strengthens the dollar.

Rates up, assets down. But the assets aren’t crashing yet.

We’ll get a cut late in the year despite all economic sense, thanks to Jay Powell's goosing of Biden’s failing campaign.

Dollar Index

Okay, we’re nearing a breakout here. If we get above 107, the next level is 111. Above there, we get to the 114-115 area. Much depends on what the Fed does in the coming months. But this dollar strengthening doesn’t necessarily mean gold will head down.

USG Bonds

I called 90 last month, and I was too timid. Here we are at 88. Is there anything more hatable right now than bonds? “Yours! In size!” as my old trader friends used to say.

Investment Grade Bonds

Investment-grade bonds had a rough month as well.

After a consolidation, they’ve been dumped like their government brethren.

I can see us testing the 100 level from here.

High Yield Bonds

Junk is only off a point this month, and that’s because they act more like equity than debt.

A rangebound month may be in order again.

Real Estate

I got this one wrong. Real estate is finally hurting in the US, as one would suspect it would. 76 is our first target, and 70 is our next target.

Energy: West Texas Intermediate (Oil)

And oil does a U-turn! With inflation where it is, the world economy must be in the toilet for oil to trade like this.

It could be a breather before we head up to 92… or it could be a prelude to a fall back down to 70.

Base Metals: Copper

We blasted through my 4.30 call to 4.56.

But this rally was too much, too fast, and I can see us heading back to 4.30 before taking off again.

Precious Metals: Gold

***NEW MONTHLY RECORD CLOSE OF $2,302.90.***

From last month:

$2,609 is our new target, but it may take a few months to get there.

We needed a crappy two weeks to catch our breath. I’m still eyeing that $3,000 mark long-term.

Precious Metals: Silver

From last month:

Up $2 from last month. When silver awakens, watch out!

Above $26, and it’ll start to chase, and then surpass, Gold’s performance.

GIDDYUP!

I’m still a believer…

Cryptos: Bitcoin

I was looking for a pullback to $66,700. Only off by a “tad.”

We can get down to $52,000 before a rebound starts to happen.

Cryptos: Ether

Ether is stinking to high heaven right now, as well.

2400-2500 zone is my next target down.

Once it composes itself, we’ll see a rally again.

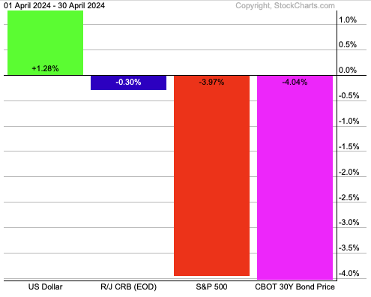

Trad Asset Class Summary

The dollar won the month, which means everyone else lost.

Commodities were pretty flat, though down slightly.

The broad market and the long bond were both down around 4%.

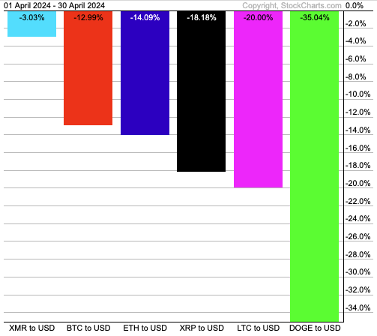

Crypto Class Summary

Crypto, in general, stunk up the joint in May.

Monero was the least affected, as it also had a rough March, down only 3% or so.

The rest were down double digits, with Dogecoin leading the way at down 35%.

Wrap Up

Stocks, crypto, and gold. It’s the same simple formula from last month.

Long live the rally!

Finally, let’s take a moment, courtesy of the Twitterverse:

Have a wonderful day!

Silver, China… and Opium

Posted May 16, 2024

By Sean Ring

Why Today’s CPI Number Matters So Much

Posted May 15, 2024

By Sean Ring

AI Fired Your Friend

Posted May 14, 2024

By Sean Ring

RIP, Jim Simons

Posted May 12, 2024

By Sean Ring

Major Miners

Posted May 10, 2024

By Sean Ring