Posted December 29, 2025

By Jim Rickards

The Shape of Things to Come

It’s that time of year again when we offer our forecasts for the year ahead. Of course, every major publication and investment bank does the same, so there is no shortage of prognosticators and forecasts. On average, about half the forecasts will be right, and half will be wrong. The difficulty is that it’s impossible to say in advance which half is right. Take your pick.

Our role is to do better than a random outcome. Our senior research analyst, Dan Amoss, reviewed our 2025 predictions from a year ago. He wrote to tell me that we went 4-for-4 on stock picks and 9-for-9 overall, including currencies and commodities. We batted 1.000, which in baseball is as good as it gets. (In the real world of baseball, the best hitters barely get to .300).

That did not give rise to any self-congratulation. Quite the opposite. My first thought was that, if we were perfect in 2025, we had nowhere to go but down in 2026. My second thought was to an old Wall Street saying – You’re only as good as your last trade. Put differently, past success is fine, but what can we offer readers now?

We’re not put off by the challenge of meeting last year’s high standard. We thrive on it. And we’re confident in our forecasts because we don’t do anything on a random basis – we don’t guess.

We use sophisticated models that combine subject matter expertise, Bayes' Theorem, behavioral psychology, history, and complex neural networks in an AI application we invented long before the current AI craze. This doesn’t mean we’re never wrong, but it does mean we can beat the crowd consistently and adjust forecasts based on new information so that we can still give early warning of material events.

Our 2026 forecasts are below in expanded form, followed by a ten-point summary for ease of reference. We trust this will be useful to you in structuring your portfolios and making significant gains in the year ahead.

Forecasting is an uncertain art, but one thing we can be certain of is that 2026 will be a wild ride. We will be with you every step of the way.

Our 2026 Forecasts

The U.S. economy. We predict the economy will slow considerably in 2026. Whether this slowdown is reflected in GDP performance is a separate issue. GDP can be propped up with fixed asset overinvestment, inventory accumulation, fiscal deficits, and reduced trade deficits (even as world trade is contracting). Those metrics may mask reduced real wages, reduced hours worked, declining labor force participation, declining home prices, slowing consumption, and increased bad debts.

In short, economic growth through borrowing and timing differences will not change the fact that everyday Americans are getting poorer. This complex interaction can be summarized as affordability. It doesn’t matter if you can’t afford things due to inflation or your own reduced income – the frustration is the same.

This dynamic favors Democrats in the mid-term elections. Control of the House of Representatives will be extremely close. Republicans will be helped by redistricting, tax cuts, and less regulation. Democrats will benefit from the affordability issue.

The U.S. economy will enter a technical recession.

Tariffs. The Supreme Court is likely to rule that the International Emergency Economic Powers Act of 1977 (IEEPA) does not give President Trump unlimited power to impose tariffs at will. However, this ruling will be of limited significance because Trump has many other statutes that he can use to support the same tariffs.

Many of the trading partners that had tariffs imposed on them have since reached trade agreements with the U.S. that allow specified tariffs. Any Supreme Court ruling will not impact those agreements. Trump will not give “tariff refunds” to complaining parties like COSTCO. In short, the ruling will create a legal muddle, but the tariffs will remain in place to a great extent.

U.S. tariffs on imports will continue and expand regardless of Supreme Court rulings.

New Fed Chair. Kevin Hassett will be the new Chair of the Federal Reserve Board, replacing Jay Powell in May 2026. Hasset will continue to cut interest rates. That will not be a form of stimulus because lower rates are the result of recession and depression, and are not a prompt for growth. The Fed is also irrelevant to the economy. What matters are the commercial banks and the psychology of lenders and borrowers.

Kevin Hassett will be the new Chair of the Federal Reserve Board.

Oil Prices. There will be a decline in stages of oil pricesto the $45.00 per barrel level or lower. This is not due to “oversupply” but rather to a steep decline in demand as global economies slow. A forecast of declining demand is consistent with our thesis that global growth and U.S. growth in particular will be slower in 2026. That said, increased U.S. supply will be another factor pushing oil prices lower. This will not hurt U.S. suppliers. Any reduced demand in the U.S. will come at the expense of Mexico, Canada, and Saudi Arabia.

Oil prices will fall to $45.00 per barrel or lower.

Major AI stocks. In 2026, we believe AI stocks,including NVIDIA, Microsoft, Apple, Meta, Oracle, and Google (Alphabet) will decline sharply in 2026. This does not mean the end of AI. Instead, it will reflect write-offs from overinvestment in semiconductors, data centers, large language models, and development costs.

Superintelligence will not emerge. Errors in GPT chatbots will increase. Training sets will become diluted and contaminated by erroneous outputs from prior AI chatbots. Developer bias will skew output in the same way that Wikipedia has been taken over by neo-Marxists.

Some applications will reduce costs in some businesses, but these gains will be swamped by poor output in the most popular apps and by write-offs from overinvestment and bad debts from vendor finance. One of the winners will be Anthropic, which has led the way in curated training sets.

An index of NVIDIA, Apple, Microsoft, Meta, Google, and Oracle will fall 30% or more.

The War in Ukraine. We see the war dragging on into 2026 as Russian territorial gains increase. In the end, Ukraine will surrender with far less territory than they could have with a peace treaty today. Zelensky will be forced to flee or be killed, but he will be replaced by another neo-Nazi just as corrupt. U.S. support will dry up, and European support will be exposed for the sham it is.

Russia will be victorious in the War in Ukraine, and Zelensky will flee or be killed.

Gold Prices. Goldwill reach $5,000 per ounce in 2026, possibly much higher. You know about the run-up in gold prices; it's become a mainstream media story. But the gold situation is bigger than that. There are important developments almost daily that will sustain the gold bull market for years to come.

Gold is in its third great bull market. The first bull market (1971 – 1980) saw gold soar 2,200% in eight years. The second bull market (1991 – 2011) witnessed a 670% rally in gold prices over 12 years.

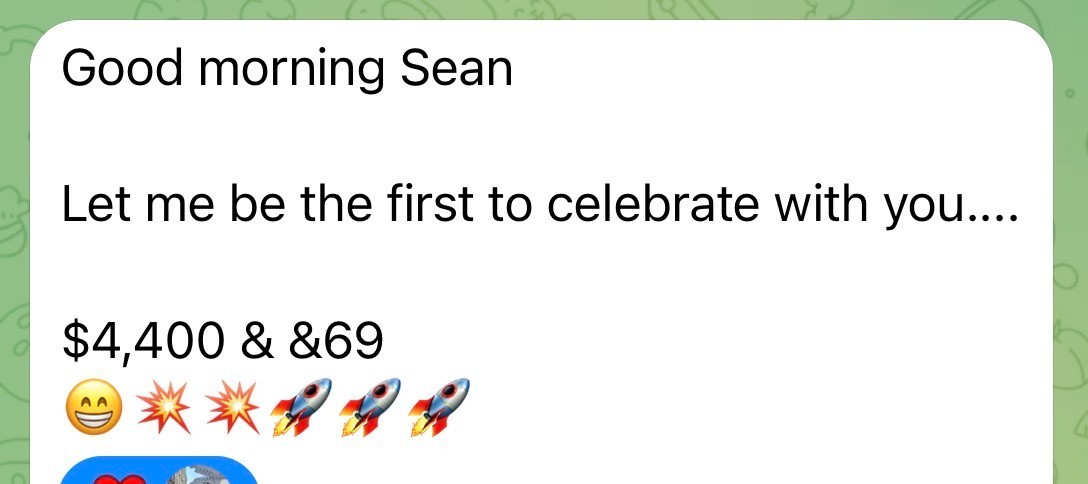

The third bull market (which we are in today) can be more difficult to date. If one begins at the interim low of $1,050 per ounce in December 2015 and ends at today’s price of $4,400 per ounce, the gain is 319% over ten years, which is less than the two prior bull markets. (Of course, this bull market is far from over, and material gains in the near future should be expected.)

However, gold traded in a range of $1,000 to $2,000 per ounce for almost all of 2015 – 2025, until July 1, 2023, when a breakout above $2,000 per ounce began. If we date the bull market from that point, we see a 110% rally in just over 2 years.

If we take the average gain for the first and second bull markets, which is over 1,400%, and take an average duration of ten years, and apply those metrics to a baseline of $2,000 per ounce in 2023, that suggests gold will reach $28,000 per ounce by 2033. Of course, this method is arbitrary. Gains could be much larger and come much faster. A replay of the 1971 – 1980 scenario would put gold close to $100,000 per ounce by 2032.

With this as background, it’s entirely reasonable to suggest gold could reach $5,000 per ounce by late 2026 on its way much higher.

What few investors may realize is that each $1,000 increase in gold's price is easier than the one before. The price gain is the same at each milestone, but the percentage increase is smaller because each increase is working from a higher base. Going from $4,000 to $5,000 per ounce is a 25% gain. But going from $9,000 to $10,000 per ounce is only an 11% gain. This is why the push to $10,000 per ounce will go slowly at first and then quickly.

Boots on the Ground. Your editor on a gold mine drill rig in the Val-d’Or (“Valley of Gold”) region of Quebec Province. The rigs drill and remove a core sample, which is then evaluated by expert geologists both for gold content as well as other minerals that might indicate the presence of gold, silver or copper in nearby deposits. The cores are combined with data from seismographic surveys as a basis for deciding whether to expand drilling or to abandon the site.

Boots on the Ground. Your editor on a gold mine drill rig in the Val-d’Or (“Valley of Gold”) region of Quebec Province. The rigs drill and remove a core sample, which is then evaluated by expert geologists both for gold content as well as other minerals that might indicate the presence of gold, silver or copper in nearby deposits. The cores are combined with data from seismographic surveys as a basis for deciding whether to expand drilling or to abandon the site.

That much is widely known. What is less well known is a series of underreported events that will turbocharge the price gains ahead. Here is a summary of those events:

- Central banks remain net buyers of gold as they have been since 2010. This puts an informal floor under the price of gold.

- Mining output has been flat for the last six years. This does not mean “peak gold,” but it shows that gold is getting harder to find and more expensive to mine.

- The copper-to-gold price ratio is at an all-time low. This speaks to the relative role of industrial metals versus precious metals. The gold price can rise in recessionary scenarios and depressions. Gains are not limited to periods of inflation and hot economies.

- Russia has demonstrated that it can survive Western dollar-based financial sanctions by holding over 25% of its reserves in physical gold.

- Digitally tokenized gold has become a huge new source of demand. Tether is leading the way with its XAUt token that has a current market cap (tied to the price of gold) of $2.2 trillion. The gold held in vaults to support the token now exceeds 16.2 metric tonnes, more than some countries. Tether is the ultimate buy-and-hold gold investor, and their gold is effectively off the market.

- Italy has recently taken steps to assert that Italian gold (2,452 metric tonnes; the third largest gold reserve in the world after the U.S. and Germany) belongs to the Italian people and not to the Bank of Italy. That dispute has cooled down but its mere existence shows that a global struggle for possession of physical gold is underway.

- The U.S. Treasury is giving serious consideration to revaluing its gold reserves by causing the Federal Reserve to restate the value of its gold certificate given when the Treasury took the Fed’s gold in 1934. The current value of the certificate is $42.22 per ounce. If revalued to $4,300 per ounce, this would not change the world price of gold (it’s just an accounting entry), but it would add about $1 trillion to the Treasury’s account at the Fed and it would show that the U.S. treats gold as a legitimate monetary asset.

Other material developments in the gold markets are occurring almost daily. We expect this to continue. If you have not invested in gold yet or if your allocation is small, it’s not too late to invest. The biggest gains are still ahead and will happen sooner than later.

Gold will reach $5,000 per troy ounce or higher.

Market Predictions. The stock market indices will decline by 10% or more. A 30% to 50% crash is possible, but even a 10% decline in the full year will be a shock to investors. The decline will be led by AI stocks (down 30% or more) but will be amplified by declines in automobiles, consumer durables, pharmaceuticals, and electronics. Winners can still be found in energy, defense, natural resources, minerals and mining, and agriculture. Also, the yield on the 10-year Treasury notes will fall to 3.0% or lower during 2026.

The S&P 500 stock index will fall 10% or more.

The defense, energy, minerals & mining sectors will outperform the S&P 500 index.

The yield-to-maturity on the 10-year Treasury note will fall to 3.0% or lower.

With the foregoing as background, here is my list of predictions for the coming year.

My Ten Predictions for 2026

- The U.S. economy will enter a technical recession.

- U.S. tariffs on imports will continue and expand regardless of Supreme Court rulings.

- Kevin Hassett will be the new Chair of the Federal Reserve Board.

- Oil prices will fall to $45.00 per barrel or lower.

- An index of NVIDIA, Apple, Microsoft, Meta, Google, and Oracle will fall 30% or more.

- Russia will be victorious in the War in Ukraine and Zelensky will flee or be killed.

- Gold will reach $5,000 per troy ounce or higher.

- The S&P 500 stock index will fall 10% or more.

- The yield-to-maturity on the 10-year Treasury note will fall to 3.0% or lower.

- The defense, energy, minerals & mining sectors will outperform the S&P 500 index.

The Event No One Has Thought Of

Forecasting or predictive analytics is what we do. Our track record is excellent, including against-the-odds calls on Trump’s victory in 2016, the Brexit vote, the 2020 pandemic, and the exact number of electoral votes (312) that Trump would score in 2024. We have the best record in the business. No one else comes close, including well-known names like Nate Silver, Ian Bremmer, and Nouriel Roubini.

Still, in my experience, the event that is most impactful in any year is the event no one has thought of. It’s the event that’s not one anyone’s list. If no one has anticipated an event, then no one is prepared for it. That’s why it’s so impactful.

At the beginning of 1994, almost no one expected Mexico to be broke by December. They were. At the beginning of 1998, no one expected Long-Term Capital Management to threaten global market stability by September. It did. In January 2020, almost no one expected a global pandemic that would take stock markets down 30% by the end of April. That’s what happened.

That said, here are the three greatest market threats ahead in our estimation:

3 Greatest Threats to Markets for 2026

- An escalation of the war in Ukraine that moves the world closer to nuclear war

- A “run on the bank” scenario in stablecoins that threatens contagion in the main banking system

- A collapse in AI-related stock valuations that spreads to broader stock market indices.

The best approach to the unknowable is to prepare with asset allocations that are robust in all states of the world. This means true diversification, including cash, gold, silver, Treasury notes, land, and stocks in sectors like defense, natural resources, and agriculture.

In an unforeseen crisis, that portfolio will have winners and losers, but will do well overall and outperform portfolios stuffed with equities. In all events, that diversified portfolio will preserve wealth and live to fight another day.

Best wishes to you and yours for a joyous holiday season.

A Copper Melt-Up in 2026, and “Tech” Meltdown

Posted December 26, 2025

By Byron King

Bonding Over Christmas

Posted December 25, 2025

By Sean Ring

Oil Off The Boil

Posted December 24, 2025

By Sean Ring

Gold Bars, Up Bars, and FUBAR

Posted December 23, 2025

By Sean Ring

EX-SQUEEZE ME!

Posted December 22, 2025

By Sean Ring