Posted October 22, 2025

By Sean Ring

The Pyrrhic Rally

“How are the markets doing?”

“Whore’s drawers, mate. Up and down. Up and down.”

- A conversation on the trading desk in London, two decades ago…

After narrowly defeating the Romans at the Battle of Asculum in 279 BC, King Pyrrhus of Epirus allegedly said, “One more such victory and we are utterly ruined.”

Pyrrhus was a Greek ruler and general who fought the Roman Republic during the Pyrrhic War (280–275 BC). Those “victories,” where you lose almost as much as you win, are called Pyrrhic victories.

Monday, when we regained a bunch of Friday’s losses, was a Pyrrhic victory. Monday was a 5% win day. Yesterday, we lost as much as 15% on some stocks. For a goof, I asked AI how many 5% win days followed by 15% loss days would wipe us out completely. It was 247 days to zero.

But you’d lose 50% by day 15. You’d lose 90% by day 42. The rest of the days are fights over pennies.

So this pattern needs to disappear, and fast! So what happened?

Why the Metals Got Trounced

Let’s go through the possible reasons for this crazy sell-off.

Conspiracy

Did the bullion banks get together and crush the futures prices of gold and silver?

It’s perfectly possible, though I think the metals themselves were ready for a pullback without any political intrigue. In fact, I’d say The Donald would be upset at any coordinated bank action, as this makes it harder for him to make the revaluation argument.

@thesilverhermit explained it this way:

For those of you who are new to the space, this was a classic ambush by the bullion banks. We know for sure that London is running out of physical silver (as evidenced by the large premium of the spot price over the futures price), and that there is a surge in investment demand in countries such as China and India. This threatened the very existence of the LBMA, a fractional reserve market which is highly leveraged, and has been instrumental in suppressing the prices of precious metals for many years.

So they allowed the prices to run for a while, luring in new investors who never owned any physical gold or silver, but wanted to bet on their price, often with leverage. And once enough of them were in, they did what they always do - they dropped a shitload of futures contracts on the market, at an early hour, when New York is asleep and the volume is thin. This pushed the price of silver below $50 an ounce, triggered a bunch of stop-loss orders, and created a cascade in the price. As a matter of fact, it seems that this cascade is not over, and may continue in the coming days, taking the price as low as $46.5/oz.

The purpose of this cascade is to generate a "shock and awe" effect, which will frighten investors and prevent them from buying gold and silver. Now that silver is trading below $50, they can pretend as though this rally was a random spike, just like 1980 and 2011. This way, they hope to stabilize the LBMA and continue controlling the price forever.

But if there is a genuine shortage of silver, their efforts will eventually fail. With or without the retail investor, the amount of silver available for sale will continue to shrink, until these tricks and manipulations no longer work. This is why we advise people to buy physical silver, without any debt or leverage. Those who stack the physical metal can withstand large drawdowns like we've seen today and cannot be easily shaken out of their position.

There is definitely trouble in London with silver liquidity. But I’d rate this explanation as a “possible, but only a very slim chance.”

The Game

Another reason is that hedge funds realized how much they left on the table by not being in metals since the beginning. As miners prepare to report earnings, they have coordinated a strike on gold and silver to crush prices and shake out the weak hands before those stellar earnings numbers are made public.

This way, they make money by shorting the stock and then repurchasing it at a lower price before a post-earnings pop.

Maybe, but only a slightly bigger chance than the first choice.

Technically Overbought

Both gold and silver were completely overcooked, and speculators took their chance. Here’s gold’s chart. Notice the Relative Strength Index (RSI) on the bottom pane. It has been in an overbought state since September.

Here is silver’s chart. It shows much the same, though not as long.

This is the most believable explanation there is. Now, it could have been both hedge funds and banks selling, but there is a good reason for this.

Reasons to Stay the Course

Though both gold and silver were overbought, and the sell-off took the miners down with them, there are two immediate reasons not to dump your positions here.

Earnings Season

Doing a quick search, here are some of the more important miner earnings reporting dates from the unofficial Rude portfolio:

Remember that oil prices have been going down while metal prices have taken off. We should see tremendously profitable bottom lines being reported. If that doesn’t happen, then we’ll have to rethink our whole thesis. But not before then.

Reality

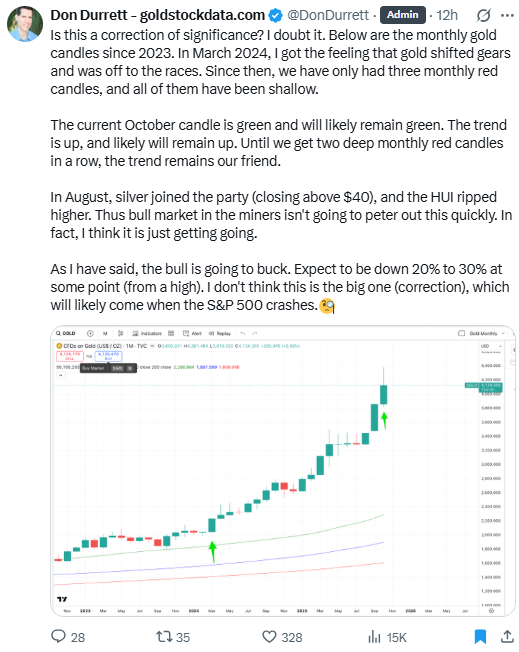

I’d also present you a zoomed-out view, from Don Durrett, one of the finest metals analysts out there:

Wrap Up

Yesterday was an awful bloodbath, like Friday. And today, both silver and gold are slightly down again. But soon, the market will catch its breath and see the light. Newmont Mining reports tomorrow after the market closes. It’ll set the tone for the entire earnings season.

Sit tight until then. Let’s see what unfolds.

Everything Rally Returns as Markets Go “Comical Ali” On Us…

Posted October 21, 2025

By Sean Ring

Red Screens, but a Clear Mind

Posted October 20, 2025

By Sean Ring

HODL Your GODL!

Posted October 17, 2025

By Sean Ring

I See Black Gold Risin’…

Posted October 16, 2025

By Sean Ring

Powell Pivots: QT Ends, QE Begins

Posted October 15, 2025

By Sean Ring