Posted February 06, 2026

By Matt Badiali

The Metal That Powers AI

Look out. The price of one of the building blocks of modern life just exploded…

Copper remains one of the world’s most important (and overlooked) metals. Over the years, I’ve written tens of thousands of words on the significance of the red metal. I ran a copper exploration company based on my research of copper demand.

All the way back in 2016, I pounded the table on copper. Even then, the math was clear. We don’t produce enough copper to meet future demand.

I told everyone who would listen to buy giant copper miner Turquoise Hill (NYSE: TRQ) for $3 per share. Rio Tinto (NYSE: RTP) acquired the company in 2022 for C$43 per share. Sadly, the COVID crash knocked us out of that trade before the acquisition.

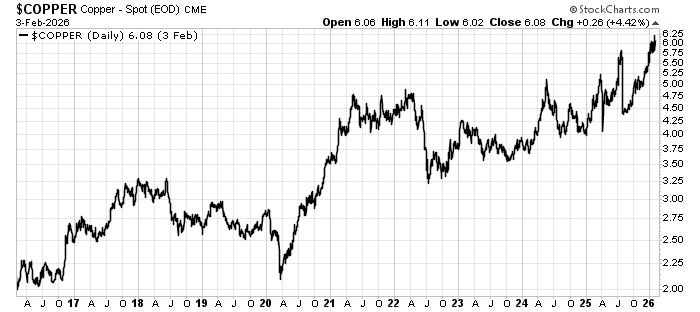

Without a significant reduction in demand or a massive increase in supply, we will see a big squeeze in copper. And when that happens, the price must rise, which is why we see all-time highs today.

Our long case for copper remains correct, as you can see here:

As we enter the age of AI and massive data center buildouts, copper is more important than ever. And the supply/demand curve points to even higher prices.

According to S&P Global, copper supply could fall ten million metric tons short of demand in the next 14 years. Here’s what that means according to the analysts:

The shortage would be 23.8% shy of the projected demand of 42 million mt by 2040, even as recycled copper scrap more than doubles to 10 million mt, according to the "Copper in the Age of AI: The Challenges of Electrification" study.

Without significant changes to supply, global copper production is projected to peak at 33 million mt in 2030 before declining, while demand is expected to surge 50% from current levels, driven by accelerating electrification across multiple sectors, according to the study. The widening disconnect highlights copper's dual role as both enabler and potential bottleneck for the energy transition and digital transformation.

In other words, if you’re a tech bull, you’re also a copper bull. The limited copper supply creates a “systemic risk” for AI.

The New Oil Is Red

The U.S. government now lists copper as a “critical metal.” According to Carlos Pascual, S&P Global’s Sr. Vice President of Geopolitics and International Affairs:

“Copper is the connective artery linking physical machinery, digital intelligence, mobility, infrastructure, communication, and security systems; the future availability of copper has become a matter of strategic importance."

It’s easy to see why experts call copper “the new oil.” The supply of the metal will rework geopolitics in the same way that oil did in the early 20th century. Those who have it, like Chile, Peru, and the Democratic Republic of Congo, will be able to influence those who need it. Imagine a three-country OPEC, based in South America.

Those three countries account for 61% of global copper production. The next closest, China, Indonesia, and the U.S., account for just 22%.

Critical Metal, Critical Moment

The Global X Copper Miners ETF (NYSE: COPX) reacted to higher metal prices. But we don’t believe it captures the full value of these producers:

COPX is the best way for retail investors to get access to copper miners right now. However, the setup in copper is so good today that we can move further down the food chain in this sector. We can take more risks and make larger gains without the fear of a price collapse.

ANNIHILATION!

Posted February 05, 2026

By Sean Ring

How The Machine Ate Itself

Posted February 04, 2026

By Nick Riso

My Secret to Finding Great Miners… and Avoiding Promoters

Posted February 03, 2026

By Matt Badiali

The Massacre of the Innocents

Posted February 02, 2026

By Sean Ring

METALS MELTDOWN!

Posted January 30, 2026

By Sean Ring