Posted July 11, 2025

By Sean Ring

The Devil’s Metal Rises!

Silver bugs, rejoice.

The “devil’s metal” is trading its best session in months, up 1.53% to trade at $37.60 an ounce. That’s not a typo. That’s a 13-year high.

And it didn’t stop there. Yesterday, silver futures held the line, trading between $36.60 and $37.69. If you’re keeping score, these are levels we haven’t seen since 2011—the last time silver made a serious run at $50.

Later that year, it got slaughtered by a rising dollar, declining inflation, and a coordinated COMEX beatdown.

But this time? This time feels different.

The Case for a Continued Silver Bull Run

Let’s break down why silver’s just getting warmed up—and why that $40–$42 target by year-end may be conservative.

Trade War Turmoil Means Safe-Haven Silver

When the world gets messy, money goes looking for cover. And right now, the world’s a dumpster fire with a gusty geopolitical wind blowing straight into the metals market.

The U.S. just slapped new tariffs on Canada. Brazil’s already smarting. China’s threatening to retaliate on everything from semiconductors to soybeans.

There are raging wars in Ukraine and the Middle East, and Taiwan is on deck.

Uncertainty is the new normal. And when that happens, capital flows toward safety, and silver, despite its volatility, is finally back in that conversation.

Gold’s Moonshot Is Dragging Silver Up

Gold is trading above $3,340/oz, just $100 off its all-time high. Historically, when gold leads, silver eventually follows… like a younger brother chasing his older brother into a party.

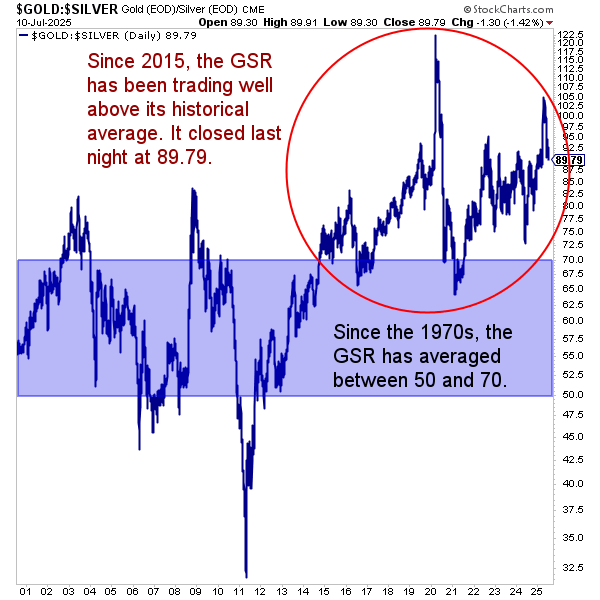

The gold-silver ratio—the number of ounces of silver it takes to buy one ounce of gold—is still elevated. It's correcting downward, which is a fancy way of saying: silver is about to play catch-up.

If that ratio even flirts with historical norms, silver could rally another 15–25% from here.

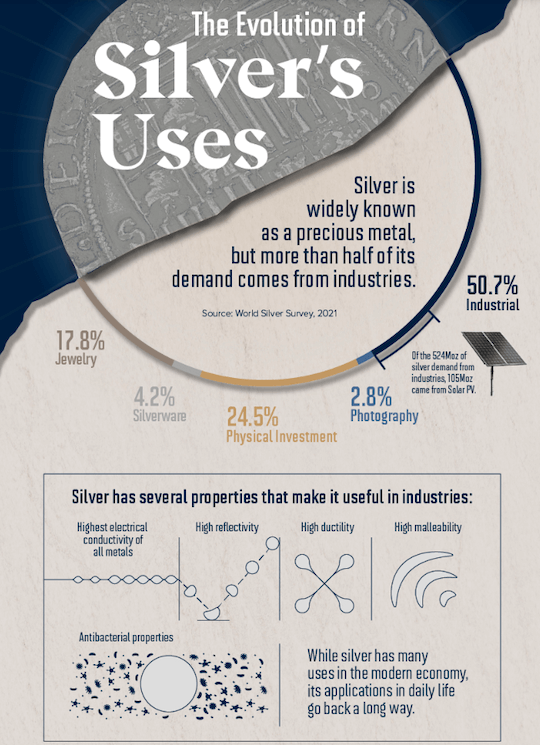

Silver Is the Energy Transition’s Secret Weapon

Forget the shiny coins and grandma’s flatware.

Silver is now tech-critical. It’s essential to solar panels, EVs, semiconductors, and the growing market for medical devices.

Credit: Visual Capitalist via JM Bullion

The solar sector alone is eating up the supply of silver. (That falls under the industrial usage in the above infographic.) This brings us to...

The Silver Deficit

The numbers don’t lie:

- Projected 2025 demand: 1,148.3 million ounces

- Projected 2025 supply: 1,030.6 million ounces

- Shortfall: Over 117 million ounces

And no, that isn’t going to be filled anytime soon. Mine production isn't ramping up fast enough. Recycling is flat. Above-ground inventories are being drawn down.

In other words, we’ve got more buyers than sellers.

Technical Breakout: A Chartist’s Dream

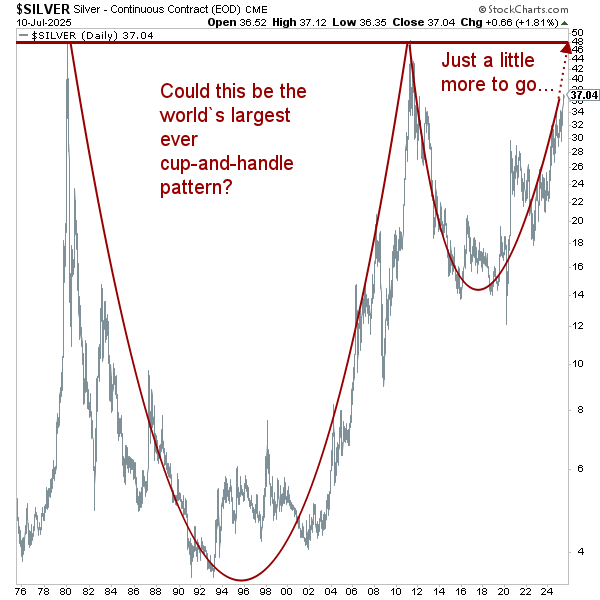

Silver has finally, finally broken through its multi-year resistance at $30–$32. It didn’t just poke its head above the ceiling—it smashed through and is building a new floor above it.

The cup-and-handle pattern was developed and popularized by William J. O’Neil, an American investor and author. He introduced the concept in his 1988 book, How to Make Money in Stocks. O’Neil’s detailed criteria for identifying and trading the pattern have made it a go-to staple among technical analysts and traders.

A cup-and-handle pattern is a bullish chart pattern technical analysts use. It signals a probable continuation of an uptrend.

After the obvious pattern forms, the price breaks above the previous highs defined by the cup’s rim, often accompanied by a surge in trading volume. That’s the breakout we’re looking for. If silver breaks above $50, it’ll almost certainly be the beginning of a new surge, not the end of the bull market.

This isn’t your uncle’s silver spike. This is a structural re-rating of the metal.

A shift in perception. A breakout with legs.

Dollars, Debt, and Dovishness

Inflation’s still lurking. Government debt is ballooning. And the Fed is boxed in.

If Jay Powell pivots even slightly toward rate cuts—or if the dollar continues its slow-motion collapse—silver will be waiting with a baseball bat.

Because, unlike bonds, silver doesn’t default. Unlike cash, the Fed can’t print it.

Where to From Here?

Wall Street’s tepid forecasts have finally started to reflect the underlying economics. Analysts are now calling for year-end targets of $40–$42. Some analysts are even hinting at $45 or higher if gold keeps on ripping and silver’s industrial squeeze tightens.

From Kitco:

This rally positions silver futures for their highest closing value in over 12 years, bringing the metal within striking distance of the $40 target that many analysts now consider a floor rather than a ceiling for 2025.

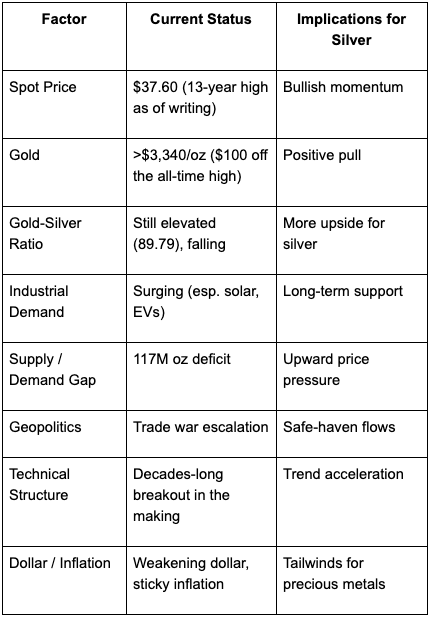

Here’s the current lay of the land:

Wrap Up

Look, silver’s not a smooth ride. It’s volatile, thinly traded, and manipulated to hell and back.

But when it runs? It really runs.

The conditions are right: a gold-led rally, industrial demand boom, structural deficit, technical breakout, and monetary policy tailwinds.

If you’re in already, well done. If not… don’t wait for $50 headlines to jump on board.

This rally is getting started.

Have a wonderful weekend!

Brazil Pays for Prosecuting Trump’s Buddy

Posted July 10, 2025

By Sean Ring

Trump’s Copper Craziness

Posted July 09, 2025

By Sean Ring

The DOJ Killed Itself! (Unlike Epstein)

Posted July 08, 2025

By Sean Ring

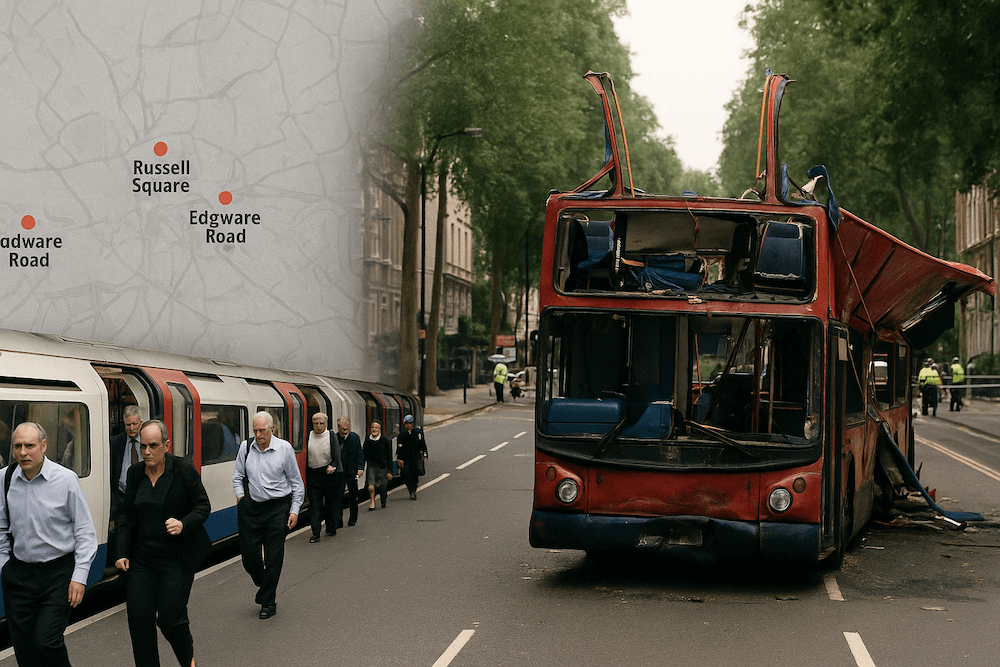

The Day London Bled

Posted July 07, 2025

By Sean Ring

Born in the USA!

Posted July 04, 2025

By Sean Ring