Posted January 28, 2026

By Sean Ring

Thank You, Mr. President!

From Monday’s Rude, in case you missed it:

Let’s face it: agree with him or not, the President’s dollar detonation strategy is working. And when a government is incentivized to cheapen its currency to monetize its debt, it's madness for investors to fight that policy. Going with the flow is the easiest money you’ll ever make.

Tempting though it is, I mustn’t take the credit. My good friend and Paradigm Press Project Prophecy 2.0 guru, Alan Knuckman, had been saying for years that the dollar would get cheaper. I remember arguing against his thesis, asking why anyone would rather own euros than dollars.

Well, it’s plain to see Alan was right. Just look at how the euro roared against the dollar over the past two years:

And now, the dollar's weakening is so obvious, even the lamestream media is discovering it!

Dollar Dump

Alan kindly posted an article from MarketWatch, which read:

The U.S. dollar fell to its lowest level in four years on Tuesday, despite President Donald Trump claiming it was “doing great” in a speech in Iowa.

The greenback has retreated in the year since Trump returned to the White House, a stretch that’s been punctuated by frequent tariff threats, strains in U.S. international relations and domestic strife, now playing out in Minnesota.

Specifically, the ICE US Dollar Index fell to $95.86, down $1.18, or 1.2%, sinking against a basket of rival currencies to its lowest level since Feb. 17, 2022, according to Dow Jones Market Data.

As a daily percentage decline, it was the worst day since April 10, 2025, when the dollar index tumbled 2% as markets convulsed in the wake of Trump’s “Liberation Day” tariffs.

The dollar index indeed took a beating, as you can see from the daily chart:

Why did this happen? Well, that’s easy.

Your Commander-in-Chief approved of the move. When a reporter asked him if the dollar had fallen too much already, The Donald said, “No, I think it’s great. I mean, the value of the dollar. Look at the business we’re doing. No, the dollar’s doing great.”

In fairness to him, when another reporter explicitly asked if he wanted a cheaper dollar, President Trump followed up by saying, “No, I want it to be, just seek its own level, which is the fair thing to do.” But by then, every FX trader, algo, and bot in the world had already hit the sell button.

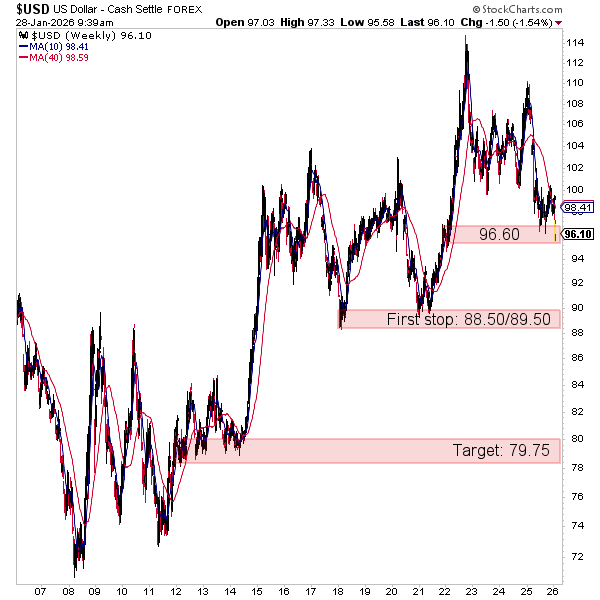

If you recall from Monday’s Rude, I posted the weekly dollar index chart with technical targets. I’ve updated it below. Though I made the band wide for legibility, we’re 50 ticks below the 96.60 level now. So it’s a good bet the dollar index will fall to the 88.50/89.50 area.

If we get to that level and the President is as happy then as he is now, the dollar will probably plunge to the 79.75 area.

My Precious!

Thanks to this Decree of Presidential Contentment, as of 5 am NY time this morning, gold is trading at $5,279 (having nearly breached $5,300 earlier this morning) and silver is trading at $113 after reaching over $116.

Incidentally, the new hourly target for silver is a salivating $128.29, while gold’s is in close reach at $5,310.05.

Monetary policy is one reason I’m hanging onto my gold and silver positions. As I wrote in yesterday’s Rude:

Silver also trades in line with monetary policy. Easing interest rates put a bid under precious metals. Investors looking for protection against money printing and fiscal recklessness have been buying real assets.

Silver benefits from both sides of that equation: monetary demand when confidence wobbles and industrial demand when infrastructure and electrification spending continue.

That combination creates a market that will run hard and then correct hard, without the larger trend necessarily being over.

My friend and Daily Reckoning editor Adam Sharp concurs. He lists as his reasons in his piece $110 Silver Tests The Faithful. Read it after you’re done here. It’s well worth it.

The Alternatives

When financial advisors talk to clients, they need to assess their clients’ risk ability and risk tolerance. Risk ability is the mathematical, quantifiable numbers behind a portfolio. In essence, it’s how much can this person afford to lose in a year? This one’s easy to figure out, but we don’t need to worry about that right now, especially if you’re way up on your precious metals.

What’s important is your risk tolerance. This is a tougher one to get a hold of. Essentially, the question is what kind of losses are you comfortable taking? I’ve seen billionaires lose their minds over a $10,000 loss and millionaires calmly take six-figure losses. Only you know how you deal with variability.

If you got in late to gold and silver, you may have a far higher sense of urgency than I do right now. And despite what I write, you may want to take profits off the table.

If you decide to do that, the next question is “Where am I going to put the proceeds?”

We know inflation is a disaster, so cash and bonds are out. And you know how I don’t like Bitcoin. (This morning, BTC is still under $90,000. Weak sauce.)

Here are a few ideas, some of which you may already know.

Copper

My friend and colleague Byron King wrote a peach of an article about copper in the Rude on December 26th. He loves copper and Freeport McMoran (FCX). Since we ran that piece, here’s how FCX rallied.

If you bought at $53 that day, you’d already be up 18.6%. There are no signs in that chart of a slowdown, even if copper itself hasn’t rallied as hard.

Lithium

If we’re going to make electric cars, we need lithium for their batteries. It’s as simple as that. In a year from now, lithium may be as obvious a winner as gold and silver were last year.

Look at LAC, which probably has a long way to go:

Alan Knuckman recommended a great options trade on LAC in the latest Project Prophecy 2.0 Flash Buy, which he issued last night. If you’re not a Project Prophecy 2.0 subscriber, you can write in here to find out more.

Potash

I wrote about potash on January 9th in the Rude. The trade in Intrepid Potash (IPI) looks good, though I would look for a break above $35.50 before I’d buy again, just to be sure.

Wrap Up

I’m holding onto my mining position because the President just told me to. But if you want to take profits, that’s just fine. You’ve now got a few more ideas for how to deploy your proceeds if you decide to sell.

Silver Shellacking

Posted January 27, 2026

By Sean Ring

Dollar Detonation

Posted January 26, 2026

By Sean Ring

Bored of Peace?

Posted January 23, 2026

By Sean Ring

NUUK TRUMP TOWER!

Posted January 22, 2026

By Sean Ring