Posted January 27, 2026

By Sean Ring

Silver Shellacking

Let’s get something out of the way quickly: yesterday wasn’t the end of the move. It was the market punishing late money and cooling an overcooked trade.

If you glanced at silver last night and felt your guts turn to water, congratulations! You just experienced a classic rite of passage in a metals bull market. Honestly, I was more confused than scared. With a low of 101.98 and a high of 117.74, yesterday’s range was long. Like, War and Peace long. Now, that’s volatility!

But as I write this at 4:24 am ET, spot silver opened the Asian session at 103.92, a few ticks higher than yesterday’s close. Now, it’s 112.33. This is why it’s imperative to “keep your head when all about you are losing theirs,” as Kipling once told us.

Yesterday gave us a monster surge, and then a sudden stall. Next came the hairpin reversal. Futures volume reached over 312,000 contracts. And SLV? Its volume was over 393 million contracts, about 15 times the usual volume. It traded more than the SPY ETF. A busy day, to say the least.

We’ve entered the part of the cycle where price stops rewarding excitement and starts rewarding patience.

Silver got the wind knocked out of it. That’s all. And to be honest, that’s good.

What Yesterday’s Moves Mean

Silver went vertical for weeks. When markets move like that, three forces show up.

The Crowd

Every breakout buyer and momentum fund eventually piles in near the highs. That’s a setup where there are more potential sellers than new buyers.

It’s key to note that if a futures trader sold silver at yesterday’s high and closed out anywhere near the lows, it’ll be the biggest one-day trade of his life. For the guy on the other side of that trade, he just lost his house.

Bots Don’t Love Their Trades

This is bigger than emotion. Index rebalances, systematic funds, and model-driven strategies are price-insensitive. When silver rips this hard, those programs automatically shift from buyers to sellers. Talk of a multi-billion-dollar index-linked futures sell program equal to a chunky slice of COMEX open interest is exactly the kind of flow that halts upward momentum in its tracks.

Parabolic Structure

There’s no such thing as a soft landing. Blow-off moves don’t glide into new bases. They overshoot, reverse, and thrash around while the market digests the leverage.

Near term, the most probable path is more probing lower, sharp countertrend bounces, and sideways churn while the froth gets skimmed off.

But the options market exacerbates these moves.

Under the Hood

My colleague and resident Paradigm options expert Nick Riso did yeoman’s work yesterday by uncovering these stats, which he kindly posted in our editorial channel (bolds mine):

- There were 1,381 instances where two different exchanges traded the exact same contract at the exact same second for different prices. In the worst case, the price difference was $0.54. Normally, arbitrage bots fix price differences instantly. The fact that a $0.54 gap existed means the "police" of the market (arbitrageurs) simply walked off the job.

- For 12.3% of all trades today, the Bid-Ask spread was wider than $0.20. In a liquid ETF like SLV, the spread is usually $0.01. For large chunks of the day, investors were paying a 2000% markup just to enter or exit a trade. The "price" on the screen was effectively fake because the cost to touch it was so high.

- 47.5% of all trades (313,766 trades) were for exactly 1 contract. This was likely HFTs firing thousands of microscopic "pings" into the dark to find hidden buyers, creating the illusion of activity while providing zero real depth.

- Deep OTM Puts traded at an implied volatility of 222%, while OTM Calls traded at 202%. Even though traders were buying more Calls (betting on a bounce), the Market Makers were charging more for Puts. The "House" was terrified the crash would go deeper and priced the insurance accordingly.

In other words, the Big Boys were so confused that the market became meaningless. And who could blame them?

In fact, things got so bad yesterday, Goldman Sachs and its Head of Precious Metals Trading “parted company.”Methinks somebody shorted silver into this massive rally…

Macro Loves Metals

There are things we need to keep in mind.

The silver supply deficit persists, and though industry has made some progress to substitute other metals for silver in solid-state batteries and solar panels (copper), it’s far from a done deal. Industrial demand for silver is still high. The physical market is still tight.

Geopolitical turmoil between the U.S. and China has eased slightly. But export controls haven't eased, and de-dollarization hasn’t slowed. Central banks are still buying gold. (Poland just agreed to buy even more as a hedge against the euro and the EU.) We’re still heading for a monetary reset, barring some kind of growth miracle (which I think isn’t coming).

Monetary Loves Metals

Silver also trades in line with monetary policy. Easing interest rates put a bid under precious metals. Investors looking for protection against money printing and fiscal recklessness have been buying real assets.

Silver benefits from both sides of that equation: monetary demand when confidence wobbles and industrial demand when infrastructure and electrification spending continue.

That combination creates a market that will run hard and then correct hard, without the larger trend necessarily being over.

So What Was Yesterday?

Yesterday, futures and options market heavyweights with opposing views were throwing haymakers at each other.

Moves like this make me wince. They’re uncomfortable because they shake investor confidence. They make people question their entire thesis. But, as the kids say, the “paper hands” exit. Stronger hands stick around.

Trends end when the underlying macro drivers reverse or sentiment deteriorates. Or when physical tightness eases, demand rolls over, or monetary conditions turn aggressively hostile.

These things didn’t happen.

What to Expect From Here

Volatility is likely to stick around. Scalpers will sell overbought rallies. Those selloffs may overshoot. Price may spend time carving out a messy range while positioning resets.

For short-term traders, this is a difficult environment unless risk is kept tight. As a former futures broker, just thinking about yesterday’s range and volume makes me reach for Pepto Bismol.

For longer-term investors who understand the structural story, these phases are part of the journey metals bulls always take.

Silver’s character hasn’t changed. It still moves farther and faster than most assets, in both directions. Yesterday, silver simply reminded everyone of that fact.

Wrap Up

The market didn’t ring a bell at the top yesterday. It applied pressure where the structure was weakest: leveraged momentum longs. That process may continue for a while.

Beneath the noise, the same forces that powered the advance remain. As the excess gets wrung out, these foundations are what matter.

Silver looks more like it’s catching its breath than taking its last one.

Stay optimistic; this ain’t over yet.

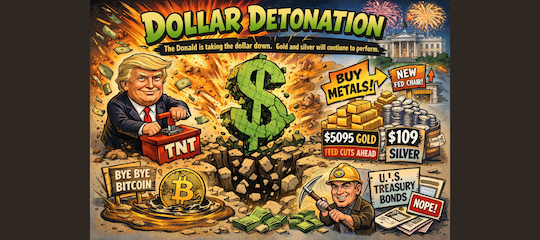

Dollar Detonation

Posted January 26, 2026

By Sean Ring

Bored of Peace?

Posted January 23, 2026

By Sean Ring

NUUK TRUMP TOWER!

Posted January 22, 2026

By Sean Ring

Yen and the Art of Market Maintenance

Posted January 21, 2026

By Sean Ring

From Oil Sheikhs to Mineral Mandarins

Posted January 20, 2026

By Matt Badiali