Posted September 02, 2025

By Sean Ring

Silver Minings Playbook

Every month, I publish this monthly asset class report not to predict the future, but to show you exactly where we are right now.

The charts are simple candlesticks, with the 50-day (10-week) and 200-day (40-week) moving averages. At the end, I present a couple of performance charts to illustrate the relative trading positions of traditional asset classes and cryptocurrencies.

If you’re a new subscriber, please email feedback@rudeawakening.info with any questions, comments, or concerns. Our mailbag is lively, and I try to publish reader feedback at least once a month. Enjoy!

It’s all about gold, silver, and gold and silver miners this month. We may be at the beginning of the biggest silver rally in modern history.

The S&P 500 and Nasdaq posted gains of around 3.5% and 3.9%, respectively, led by resilient tech stocks and improved macroeconomic sentiment. The Russell led the way with a

Bonds delivered slightly positive returns, particularly US Treasuries and global investment-grade credit, as expectations of policy rate cuts spurred investor appetite. Still, European government bonds experienced pressure from fiscal and political risks.

However, the real story is the metals. Gold climbed approximately 4.1% in the month to around $3,444 per ounce, while silver soared 4.9%, closing near $39.43, both benefiting from safe-haven demand and rate cut prospects.

In the cryptocurrency space, Bitcoin finished August up 2.5%, fluctuating between $111,000 and $124,000, despite late-month volatility. Meanwhile, Ether significantly outperformed, rising 12.8% to approximately $4,600, driven by strong institutional inflows and staking activity.

Now, let’s get to the rest of the charts.

S&P 500

***NEW MONTHLY CLOSE HIGH OF 6,460.26***

The SPX posted strong gains, rising approximately 1.9% and reaching several record highs, supported by resilient performances in the technology, financials, and healthcare sectors, despite ongoing trade tensions.

Heading into September, historical trends and expensive index valuations have led many to think we’ll see a sell-off. Maybe. But there’s nothing in the charts that screams sell. In fact, the new upside target is an absurd 9,105, though I don’t think we’ll reach that this cycle.

Nasdaq Composite

***NEW MONTHLY CLOSING HIGH OF 21,455.55***

The Nasdaq Composite closed up about 2.8%, regularly setting new all-time highs on the back of continued strength in tech stocks and positive market sentiment. Despite some volatility late in the month, AI-related companies and big tech drove the index's performance.

The upside target is a crazy 26,285. Again, that’s a far-fetched target… for now.

Russell 2000 (Small caps)

The Russell 2000, the US small-cap stock index,outperformed its larger-cap peers, posting a 9.42% return.

We’re still targeting an upside of 282.

The US 10-Year Yield

We’re in September now, so the real game begins. Does The Donald get JPow to cut only 25 bps, or 50 bps? Much depends on the answer to that question.

Either way, we’re getting the kind of inflation that props up asset prices, and that’s good for metals. Next, let’s see how the dollar index follows.

Dollar Index

Now that the Fed is sure to cut, the dollar should follow rates down, just as The Donald wants. In fact, the new downside target for the DX is a woeful 86.50. With a dollar this weak, it’s easy to see why the metals will roof it.

USG Bonds

The UST long bond ETF barely moved this month. For some reason, there’s a new upside target of 96.45. But between the coming inflation and dollar destruction, I can’t see a reason to own long-term govies.

Investment Grade Bonds

Admittedly, this chart looks great, as well. From here, the next target is 116.50, before looking at 124.50. I still won’t buy it, as I don’t buy the story.

High Yield Bonds

From last month:

Not sure if HYG can go much higher. Stalled at these nosebleed levels, a turnaround may be in order soon.

Same as it’s been for a while.

Real Estate

VNQ still looks steady, as the price objective remains 101.25.

Energy: West Texas Intermediate (Oil)

This pathetic chart provides the White House with considerable cover to cut rates and weaken the dollar. If oil were more uppity, surely that’d constrain The Donald. Instead, we’re eyeing a 54.66 price target.

Base Metals: Copper

After the copper faceplant last month, we’ve sat right around August’s level. We may fall all the way to 3.88 before staging a comeback. This was a historic blow. It’ll take some time to recover.

Precious Metals: Gold

***NEW MONTHLY CLOSING HIGH OF 3,449.25***

Let the fun begin! Gold ended the month on its all-time high of $3,449.25. I think once we get above $3,500 and, through a “reverse of polarity,” see that level go from resistance to support, we’ll be heading to $4,000 in no time. We may even get there before the year ends. That bodes well for our mining stocks.

Precious Metals: Silver

Silver ended the month at $39.71. It’s not an all-time high, but it’s the highest level since 2011. Next level up is $44.50.

We’re at the beginning of perhaps the biggest silver rally of all time.

Bonus: The Rude Portfolio

I apologize if the above is too small to read on your phone. The tickers are AG, ASM, EXK, FVL, CDE, ITR, DSV, KGC, ORLA, SBSW, and VZLA. I’ve only added VZLA on Friday by selling 50% of my SBSW position.

You’ll notice most of those charts are trending upward. This is merely the beginning.

Cryptos: Bitcoin

From last month:

We’re looking at a temporary downside target of 108,500.

Now, the new downside target is 98,816. If we hold above there, I think we’ll head back up. If not, look out below.

Are we rotating from coins into metals? That’s the question.

Cryptos: Ether

Although Ether has received great press this month and experienced massive ETF inflows, we’re still staring down a downside target of $ 3,644. Keep an eye on the rotation from coins into metals. Or, this may just be a breather before the next leg up.

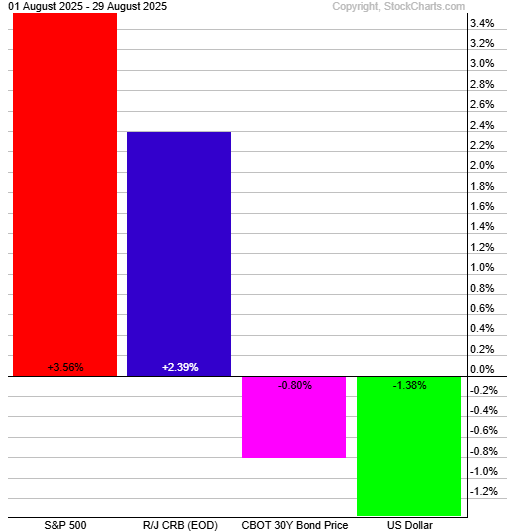

Trad Asset Class Summary

Ok, we’ve returned to some normalcy here. The dollar was down 1.38%. That set the stage for both stocks and commodities to be up 3.56% and 2.39%, respectively. The long bond fell 80 basis points. (That’s 0.80%, to be clear.)

This is a normal state of affairs (dollar down, stocks and commodities up, bonds down), so we can expect the current trends to continue.

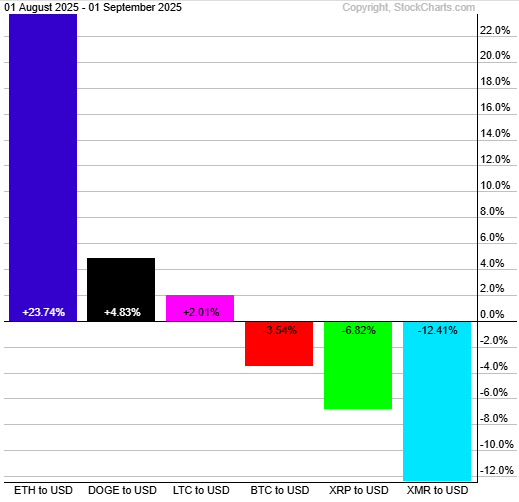

Crypto Class Summary

ETH showed the strongest positive performance with a gain of 23.74%.

The primary reason for ETH’s strong performance was a surge in spot ETF inflows and increased institutional reserves, with over $2.7 billion flowing into ETH ETFs. DOGE followed with a moderate gain of 4.83%, and LTC saw a smaller but still positive increase of 2.01%.

In contrast, BTC declined by 3.54% (Bitcoin ETFs saw outflows), while XRP dropped by 6.82% over the period. The largest negative movement was recorded by XMR, which lost 12.41%,

Wrap Up

This story is all about gold, silver, and gold and silver miners. Get in now. Don’t wait another minute. The silver rally, though Mr. Slammy is smacking it as hard as he can this morning, has only just begun. The case for metals is real, and it’s spectacular.

Finally, let us laugh, courtesy of the X-verse:

Have a great day!

X Marks the Stocks

Posted September 05, 2025

By Byron King

Google’s Great Escape

Posted September 04, 2025

By Sean Ring

How About a Weekend Staycation?

Posted September 01, 2025

By Sean Ring

A Money Pit That Saved Investors?

Posted August 29, 2025

By Byron King

A Philosophy For Living

Posted August 28, 2025

By Sean Ring