Posted December 24, 2025

By Sean Ring

Oil Off The Boil

What’s going on with oil prices?

OPEC and Saudi Arabia want more market share. And they are willing to take some short-term pain to get it.

This isn’t a new tactic. It worked well in the 1980’s and again in 2014. It was particularly effective in 2014:

The Organization of Petroleum Exporting Countries (OPEC) continued to pump a lot of oil. The extra oil in the market overwhelmed demand, sending prices down. The best way to fight shale producers in the U.S. was to cut the oil price.

In 2014, Saudi Arabia and OPEC surprised the world. Instead of cutting production to prop up a weakening crude oil price. It was a huge departure from its historical practice.

It caught the industry off guard. I remember having lunch with some bankers in Midland, Texas, in 2014. At the time, the oil industry worked on debt. Banks would lend money to the companies against their proven reserves. Drilling shale wells takes a lot of money…and the banks were happy to lend it.

The bankers I met didn’t worry about a slightly lower oil price. They hedged all their loans at $40 per barrel (bbl). The banks believed that we wouldn’t see $40 per bbl again. They were wrong.

At the end of 2015, oil prices hit their pain point. While it varied from basin to basin, most U.S. shale producers needed oil prices above $75 to break even. As the price began to fall, they cut costs anywhere they could. And the breakeven fell to the high $60 per barrel.

But that didn’t work for everyone. Roughly 180 shale companies went bankrupt between 2014 and 2018. It was a massive bust that cost investors a fortune.

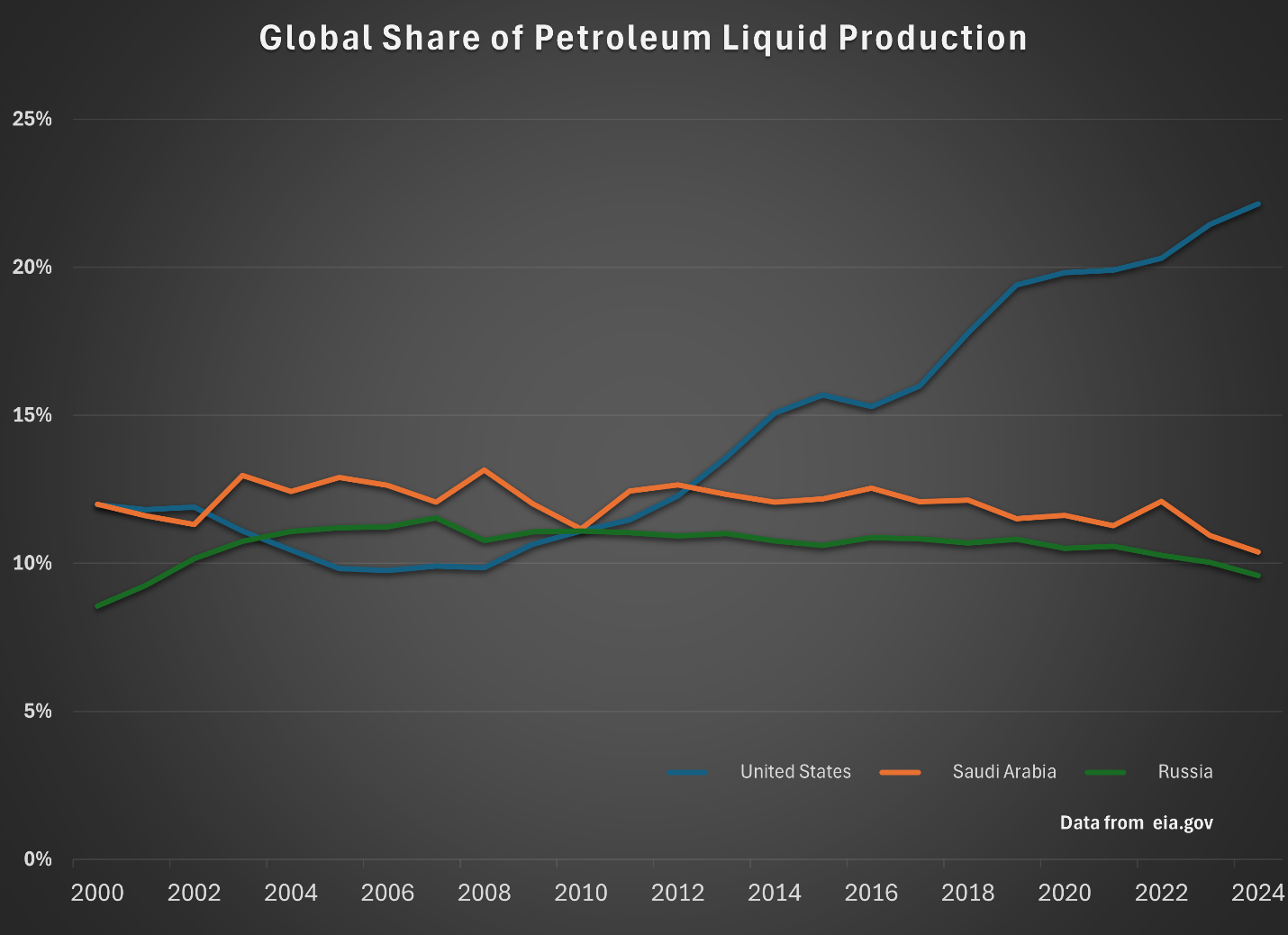

Fast forward to today, and the U.S. shale producers are back. Today, the U.S. accounts for about 20.1 million barrels of total liquids per day. That’s about 20% of the world’s supply.

And OPEC wants that market share back. History proved that a little pain in the oil price can reduce the competition. And that’s what Saudi Arabia wants.

The chart below explains it well:

Even after the brutal downturn from 2014 to 2018, the US continued to grow production. That’s a tribute to the U.S. oil industry and the shale revolution. These rocks contain so much oil, they changed the global energy market in a decade.

However, oil is sensitive to market forces. A little too much oil can send the price plummeting. A little too much demand can send it soaring.

OPEC supported the $80-per-bbl price for the last three years by removing 3.1 million bbl. per day. However, it began reducing those cuts in April 2025. And the group announced that it would add 2.2 million bbl per day to the market over the next 18 months. With no new demand looming, we could see the oil price continue to fall next year.

Today, the typical breakeven price for most new shale wells is around $60 to $70 per barrel. As you can see, the oil price is below that point now:

I’m betting on more pain in the short term. We are about to get 2026 forecasts from these producers. With low price forecasts, limited new demand, and over 2 million barrels per day coming online, things could get ugly.

And that should lead to an excellent buying opportunity next year. Not sure when, but in the first half of the year.

Gold Bars, Up Bars, and FUBAR

Posted December 23, 2025

By Sean Ring

EX-SQUEEZE ME!

Posted December 22, 2025

By Sean Ring

Swamp, Brains, and the Game

Posted December 19, 2025

By Sean Ring

WTI…WTF?

Posted December 18, 2025

By Sean Ring

Icing The Green New Scam

Posted December 17, 2025

By Sean Ring