Posted January 02, 2026

By Sean Ring

It's Been a Metals Year... and a Pick!

Happy New Year!

But before we press forward on this Friday, let us look back at the final monthly asset class report of 2025.

First, the bad news. Oil continues its descent, with no positive catalysts on the horizon, except for contrarian sentiment. If sanctions are lifted, prices fall. If war ends, prices fall. If OPEC cuts production… well, that won’t happen. So every oil executive has just joined every arms dealing lobbyist to extend the wars in the Middle East and the counterproductive sanctions against Russia.

Next, crypto. It was another off month for the crypto bros. At this point, it’s our advice to wait for the next move. If it’s down, coins will fall precipitously, and Michael Saylor’s Strategy will be dodging the repo men like Bill Clinton dodged the draft. But if the next move is up, we can see BTC and ETH at least challenge their previous highs, if not surpass them. Right now, it’s too early to tell which path they’re on.

Then we’ve got stocks. I like consumer staples and materials, but I’m wary of tech. Still, there’s no reason to sell the big equity indices right now. Their charts are nearly perfectly bullish. I would watch the Russell 2000 (IWM) ETF for early signs of directional change, but that’s all. As for bonds, I’m off USTs via the TLT ETF, but the LQD (corporate bonds) ETF looks fine.

Finally, the elephant in the room: Gold, silver, and copper. We will have our volatility, but ultimately, we’ll resolve to the upside. Gold hit $4,500 before coming back down to $4,300, but that $4,300 is still a new all-time high. As for silver, it hit $84 before crashing back down to $71.60, and yet it, too, was another all-time high. Copper reached its previous high of 5.86 before falling again, but its upside target of 6.93 makes it worth holding.

Roger Ibbotson once said that between 75-94% of portfolio returns were due to investing in the right asset class, not in particular stocks. That’s why I’m still long the miners.

Finally, I include a new ticker that I chose for the Paradigm Editors’ competition, sponsored by our fearless leader, Matt Insley.

And now, finally, to the charts.

S&P 500

Two weeks ago, the SPX had a rough one and then recovered. This is a healthy chart.

We’re only four points off last month’s record. It’s only a matter of days before that gets broken.

The next target is 7,613. After that, we target 7,963. Stay bullish.

Nasdaq Composite

We may be rounding on the tech index, but that’s not a reason to sell yet. On this chart, the Nazzie is about to violate its 10-week (50-day) moving average.

And yet, we still have a 27,707 upside target. Although the recent highs are lower, the recent lows are higher. In short, I’m not calling a top here.

Russell 2000 (Small caps)

The Russell is hitting its 50-day moving average, but that doesn’t mean to sell yet. But I would look closely at this index (which is full of money-losing companies) as a gauge of market sentiment in the early days of January.

It still has an upside target of 265 to reach. If it falters, 228 would be my first target to the downside.

The US 10-Year Yield

We’ve ticked UP 15 basis points in the 10-year after the December FOMC cut. Not to be a killjoy, but central bankers hope the long end will follow the short end down. That hasn’t happened. This doesn’t mean we’ll get a divergence, but I’d watch this space.

Dollar Index

We’re still dollar bears, but even moreso now. This month’s plunge was palpable, and the next target down is a whopping 18% away, at 79.75. If this happens, expect stocks, metals, and crypto to rally hard.

USG Bonds

Ok, we’ve finally got downside targets for TLT. As you know, I’m not a fan of bonds in this environment, and even less so now. The first downside target is 83.85, a few points away. The big one, though, is 74.75, which would be painful for any holders. Avoid.

Investment Grade Bonds

Admittedly, this chart looks excellent. From here, the next target is a whopping 140.85. But I don’t buy the story in the long term.

High Yield Bonds

From four months ago:

I don't know if HYG can go much higher. Stalled at these nosebleed levels, a turnaround may be in order soon.

Same as it’s been for a while.

Real Estate

You can see the 10-week moving average heading toward the 40-week MA. Below 87, this is worth a cheeky bet to the downside. Below 82, certainly so. The next big target is 70.75.

Energy: West Texas Intermediate (Oil)

Oil is the ugliest chart in the world right now. The world simply has too much of the stuff and not enough demand. The next three downside targets are 55.15, 53.50, and 50.50. Once those targets are hit, we can reevaluate a foray into the oil services companies for an upside bet.

Base Metals: Copper

We briefly closed above the Liberation Day high of 5.86 on the daily charts last week. My good friend and colleague Byron King argued in the December 26th edition of the Rude for a Copper Melt-Up.

You won’t find me arguing with Byron any day… and when the charts agree with him, it’s case closed. The next upside target for copper is 6.93. Stay long, my friends. Click on the link to Byron’s article for his favorite copper pick, in case you missed it.

Precious Metals: Gold

***New Daily, Weekly, Monthly, Quarterly, Yearly all-time HIGH of 4,322.61***

As the central banks have put a floor under the gold price, I can’t see an unwinding of the gold trade. Sure, we’ll have sell-offs and corrections. Heck, we already hit $4,500 and came off.

But I’m sure the trend is still up, especially with the Trump Administration and his useless Congress (I repeat myself) doing nothing to reduce spending. The BRICS know this, which is why they’ll continue to buy gold while quietly selling UST bonds. The next upside target for gold is $4,715.

Precious Metals: Silver

***New daily, weekly, monthly, quarterly, and annual all-time high of $71.26.***

We are living through the transfer of metal pricing from the West to the East. Shanghai has a more robust delivery system, whereas the West is mostly paper nonsense. Therefore, seeing Shanghai silver close the year at an 80-handle, I’m confident COMEX silver will rise to meet it, rather than for Shanghai to come down.

We’ve hit our upside targets for silver, so don’t be surprised with a correction, even all the way down to $60. But I’d ride it out, because the next upside target to be set may be triple digits.

BONUS TICKER: HSLV.TO

Our fearless leader, Matt Insley, asked us to pick the stock we think will rise the most between today (January 2nd) and December 31, 2026. I chose Highlander Silver. Now, you must understand this is a highly speculative junior silver mining stock. So if you want to invest, put no more than 1-2% of your portfolio into it. For full disclosure, I only put in CAD 7,500 (USD 5,400), which is well under 0.5% of my portfolio.

I missed Highlander Silver earlier in 2024 and 2025, and I regret it. The chart is beautiful, and it’s a silver miner, which is a good enough reason to like this stock. But here are some more reasons. Major shareholders include the Augusta Group (Richard Warke), the Lundin family, and Eric Sprott. Highlander and Bear Creek (another disclosure: I own Bear Creek warrants) have agreed to combine, creating a larger silver-focused growth company that will include the Corani project, one of the world’s largest undeveloped primary silver deposits. The San Luis project in central Peru hosts indicated resources of about 356k oz gold at 24.4 g/t and 8.4–9.0 Moz silver at roughly 579 g/t, placing it among the highest-grade gold-silver deposits globally.

If we see significant movement early on, I may add it to my Unofficial Rude Portfolio. But until then, it’s a mere flutter in my brokerage account.

Cryptos: Bitcoin

BTC looks vulnerable here, but I’m not sure which way it’ll go. So here’s how I look at it:

If we break above $93,000, we’ll challenge $100,000 again, and possibly $110,000.

If we break below $84,500, we’ll be looking at a disastrous $55,500.

But wait for the break, either way!

Cryptos: Ether

Again, I’m of two minds.

If ETH breaks above $3,300, look for $3,620.

If ETH breaks below $2,800, target $2,400.

But remember this: wait for the break first!

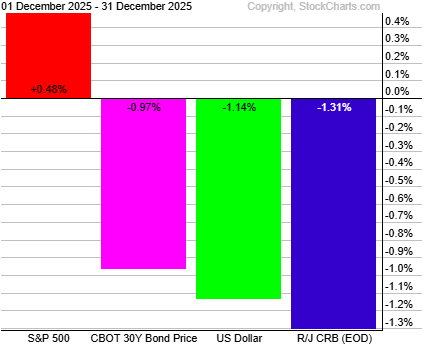

Trad Asset Class Summary

Crypto Class Summary

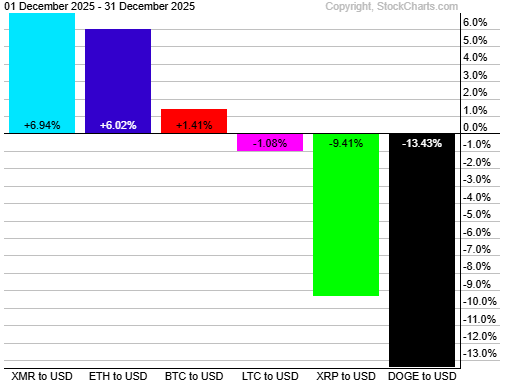

Monero was up nearly 7%, with Ether closely behind at 6.02%. BTC stopped the bleeding for a bit, recovering by 1.41%. Litecoin was down just over 1%, while Ripple was down 9.48%. Dogecoin got hammered, down 13.43%.

Wrap Up

Stocks look up, though I’m more into consumer staples and materials rather than tech. Government bonds (TLT) aren’t for me, but corporates look fine. Crypto needs to make up its mind. But gold, silver, and copper look bullish, despite the volatility.

And the less said about oil, the better.

Finally, let us begin 2026 with some wisdom, courtesy of the X-verse:

Have a wonderful weekend!

RIP, Scott Adams

Posted January 14, 2026

By Sean Ring

Worldwide Whack-A-Mole

Posted January 13, 2026

By Sean Ring

Powell Subpoenaed For Fed Renovations, Horrifying Wives Everywhere

Posted January 12, 2026

By Sean Ring

The Next Commodity Supercycle Winner

Posted January 09, 2026

By Sean Ring

The Best Stocks, Countries, and Books

Posted January 08, 2026

By Sean Ring