Posted December 23, 2025

By Sean Ring

Gold Bars, Up Bars, and FUBAR

Good morning from a soggy Northern Italy. It hasn’t stopped raining for days.

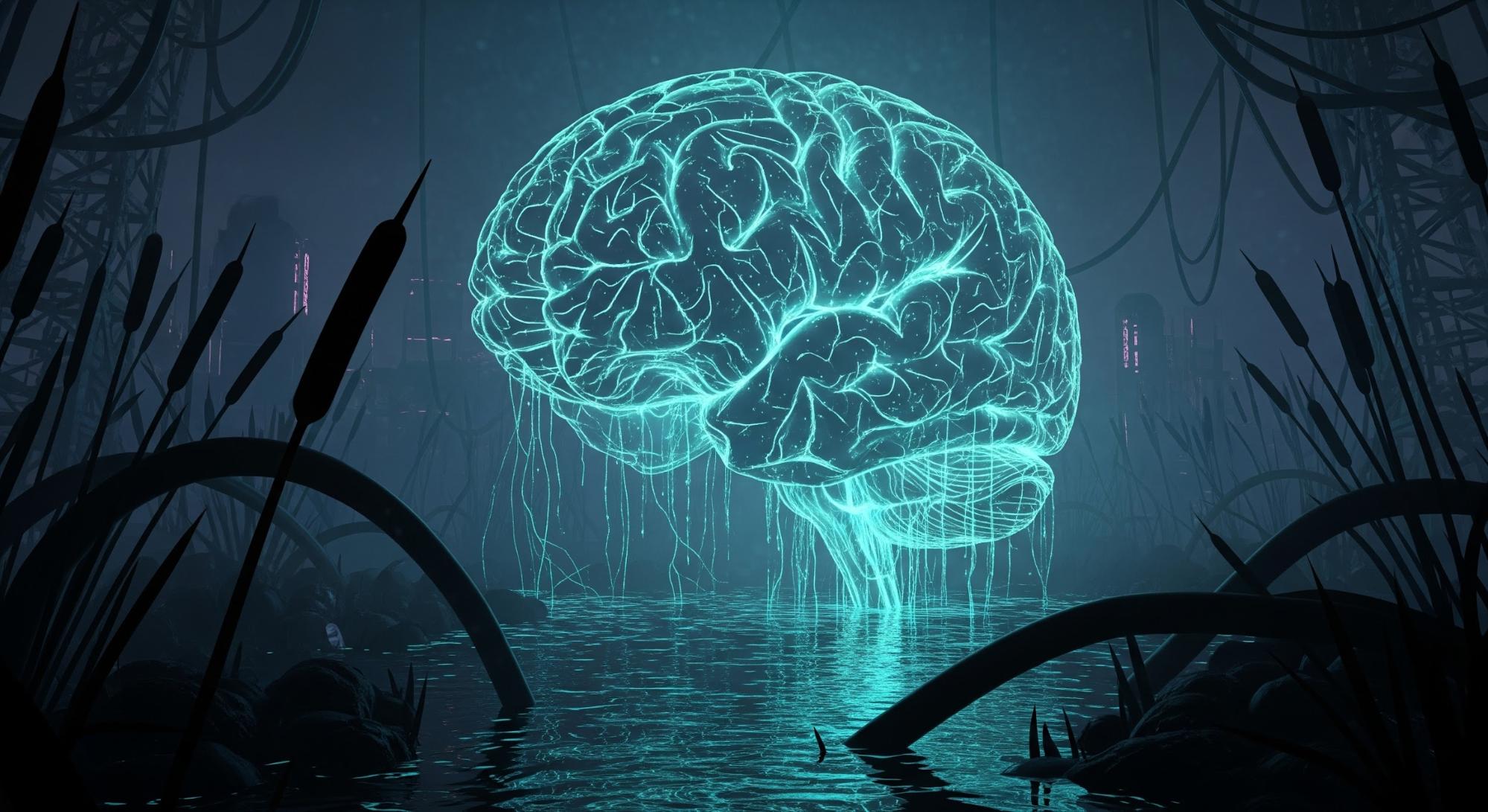

Except in the metals markets…. The bulls will brook no denial. It’s as if they said, “The rally will continue, and you will like it. That’s that.”

Well, ok. I’m not going to argue. Let the bears get the horns for messing with the bulls.

Silver and Gold (and Copper, too…)

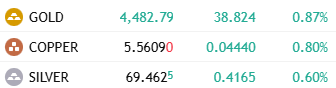

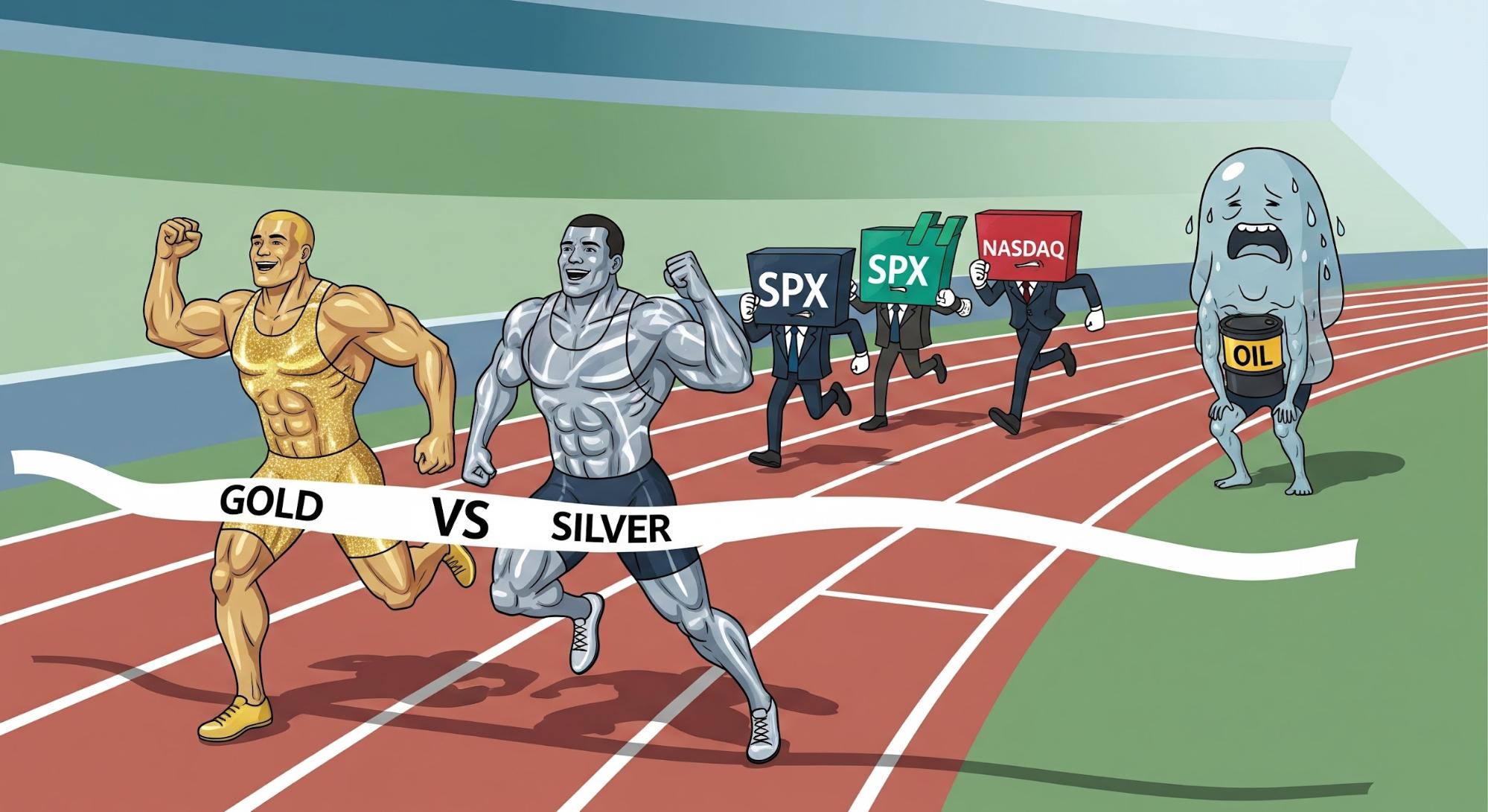

As I write this morning, the rally is continuing.

We got to 4,497.75 in spot gold and 69.99 in spot silver. Once more unto the breach, dear friends…

I know I’ve written about silver and gold pretty exclusively over the past month.

But luckily, our friend and Paradigm Gandalf, Byron King, will take over the Rude once again on Boxing Day (December 26th). He’s written a peach of a piece on copper and why that will be the metal of 2026.

And that reminds me…

WTI, WTF…

You may have seen our new Paradigm team member, geologist, and resource expert Matt Badiali in Saturday’s Daily Reckoning. There, he wrote about aluminum (or aluminium if you grew up in the UK) and gave readers a great trade idea.

I’m thrilled to let you know he’s taking over the Rude tomorrow for a short and sweet edition on the light, sweet crude we pull out of the ground Stateside.

There’s a great trade idea in there, as well. So keep an eye out for it tomorrow at 7 am ET!

Fudai Wasn’t FUBARed

If you haven’t read my friend and colleague Adam Sharp’s Daily Reckoning piece from yesterday, that’s the next thing you can do this morning.

I'll let him tell you about Fudai and how it applies to your portfolio, but read this as a sneak peek:

Gold and silver miners also have a lot of catching up to do. They’re currently priced as if this precious metals bull market is a blip, a fad. If you believe it will continue over the coming years, as we do, they should do very well going forward. Miners have become absolute cash flow machines, and the outlook remains bright.

I haven’t sold anything yet. Miners, ETFs, vault holdings, nada. These investments act as a personal floodgate. If you ever need them, you’ll really need them.

And with the trajectory the world is on, a tsunami is inevitable. This wave will come in the form of money printing and inflation at a scale that will shock the world.

We’re approaching a historic financial and monetary reckoning. Over the coming decade, we will see multiple sovereign debt crises, including an almost certain one here in the U.S.

We’ll get through it, but it’s not going to be fun or easy.

I couldn’t agree more, which is why the Unofficial Rude Portfolio looks the way it does.

Update on the Unofficial Rude Portfolio

Here’s a look at the Unofficial Rude portfolio before the end of the year. In the great words of Animal House’s Flounder, “Oh boy, is this great!”

Now, a few quick notes. Anything with either a .TO, .V, or a .WT is Canadian and is denominated in CAD, not USD. The buy price is the price we paid for them. It has a few extra decimal places because that’s the average buy price of the shares. The closing price is yesterday’s close. The return is (closing price / buy price) - 1, or our paper gains to date.

The price target is where my current Point and Figure charts are targeting. They are much lower than, say, ace mining analyst Don Durrett’s targets. Remember, he has CDE’s target at $70, ASM’s at $50, AG’s at $50, and EXK’s at $100. That’s fine, I’m sure we’ll get there. In the meantime, I’m being more conservative.

The additional return is (price target / closing price) - 1, or the distance to the price target as a percentage.

The target total return is (price target / buy price) - 1, or the total return we’d earn if we sold at the price target. Adding the return and the additional return won’t get you the same number because of the different denominators.

One more thing: I love Integra Resources. When I placed the order to buy with my pension advisor, he, stupidly… or luckily… bought me the warrants instead of the stock. Warrants are the British term for call options. As I have a British pension, I was shocked I was allowed to own the warrants. As I was yelling at how dumb a mistake he made, I realized how lucky I was and told him I’d keep the warrants. So if you bought the stock, good for you, you’re still up over 300%. As a former futures broker, this is the first error that ever went my way, so I thank the Good Lord for it!

On the options side, the HL Jan 15 2027 15 calls are up 557.29%, and the AG Jan 15 2027 17 calls are up 310.45%.

All in all, it’s been a great year. Riding this trend is the smartest thing we can do. Overtrading is one of the most common ways to lose money. This is why we’ll continue to wait for the trend to end before we sell.

Are These The Only Mining Stocks to Own?

Of course not! Remember, we used to own ABRA.TO, Byron’s great pick PGE.TO, and ORLA. I still like those stocks, even though we no longer own them. The combined Contago Ore/Dolly Varden company is another one to watch. AUMB (1911 Gold) is also on my list if we decide to rotate out of any of our holdings above.

Wrap Up

Tomorrow, I leave you in Mr. Badiali’s capable hands.

I’ll see you on Christmas Day for a bit of Bonding.

In the meantime, have a lovely Christmas Eve, and may Santa Claus get you everything you wish for.

EX-SQUEEZE ME!

Posted December 22, 2025

By Sean Ring

Swamp, Brains, and the Game

Posted December 19, 2025

By Sean Ring

WTI…WTF?

Posted December 18, 2025

By Sean Ring

Icing The Green New Scam

Posted December 17, 2025

By Sean Ring

8 Things That Will Turbocharge The Gold Price

Posted December 16, 2025

By Jim Rickards