Posted December 22, 2025

By Sean Ring

EX-SQUEEZE ME!

I was going to write a fluffy Rude about my birthday party this weekend at the very Christmasy Ring Manor. About how I prefer Italian prosecco to French champagne. About how Pam and Mama’s Filipino specialities, like lumpia and adobo, are even tastier when made with Italy’s second-to-none meat. (Yes, my in-laws are here, with more coming soon!)

The kids were running around the house with the kind of reckless abandon that makes a man want to join in and be young again, and yet, knows he’s too old for that tomfoolery and reverts to the fatherly protective role that’s rightly his now.

My friends honored me with great booze and better company. Spanish, Portuguese, Dutch, English, and Italian rang through different parts of the house. I was lightly scolded for not having mastered la bella lingua yet. Yesterday was the first recovery day I’ve needed in six months. Not bad for a 51st birthday, for sure.

Fully recovered, I woke up this morning to this message from Iowa Michael:

That put paid to the fluff. It’s time for business.

There’s No Fat Lady in Sight

First, let’s look at the spot gold chart:

This is a daily chart of the past year. You can see the purple boxes I drew earlier, showing when gold was taking a breather and moving sideways. Once we got to October’s high, gold had been overbought for a few months, as the RSI chart under the price chart shows. (An RSI reading of 70 and above is a signal of being overbought, but it’s not necessarily a “sell” signal.)

That October high close was $4,355. We fell below $4,000 before starting to recover. Today is the first day we’ve broken through that previous high level. Now that we’ve decisively broken through, the next target for gold is $4,715.

Currently, we’re trading $4,408 for spot gold and $4,440 for gold futures. That means we're in a “contango” market. I’ll get to how that’s different from the silver markets in a moment.

But first, the spot silver chart:

Silver got smashed in October, along with gold, but it recovered much faster. Silver reclaimed the prior high on not-so-Black Friday and has continued to scream higher since. Its next target is $78.50, and it may get there sooner rather than later.

Currently, spot silver is trading at $68.84, and silver futures are trading at $68.82. So we’ve got a slight backwardation there. What does that mean? I’ll take you through it. But first, let me make sure you understand futures contracts.

What are Futures?

Futures, along with options and swaps, are derivatives. Derivatives are financial instruments whose value comes from (or is derived from) underlying assets like stocks, bonds, and commodities.

Futures are obligations. Specifically, they are standardized contracts to buy or sell a specified quantity of a specified asset at a price agreed today, for delivery in the future. (Forward contracts are the over-the-counter, or OTC, version of futures.)

Simply put, futures move delivery through time. They’re not predicting the future. That is, the futures price doesn’t equal the expected future spot price.

Theoretically, a futures price is equal to the spot (cash) price plus storage and insurance costs plus foregone interest (of owning the asset) minus any income of owning the asset (which is zero for commodities). We call those costs the cost of carry. Higher rates make gold and silver more expensive to own. Lower rates make it cheaper.

Without resorting to any mathematical formulas, the futures should trade above the spot price. That’s called a contango (or normal) market. But when the spot trades above the future, that’s called backwardation.

Why would backwardation ever happen?

Industrial Value

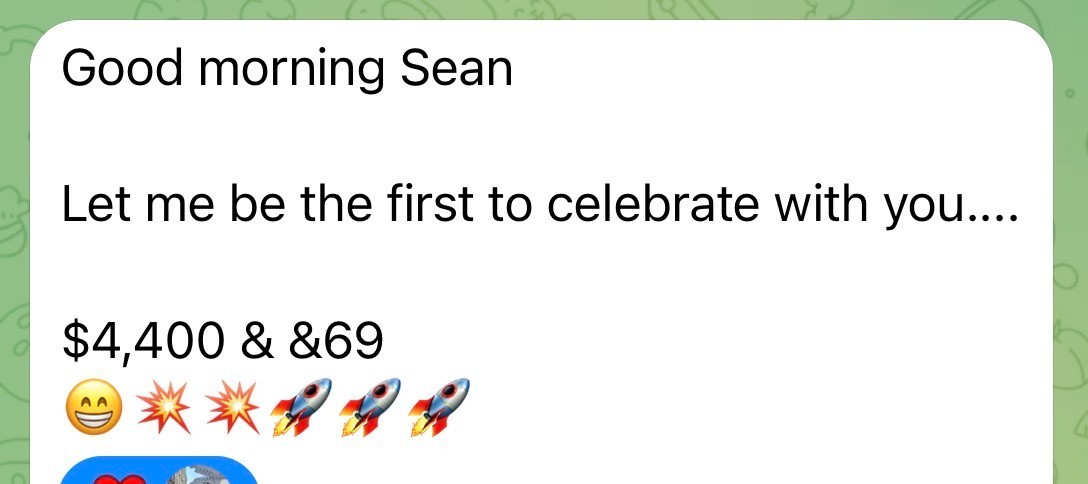

Silver is a special metal in that it has both monetary and industrial uses. And its industrial value is far greater now than it ever was. Check out this solar chart:

Credit: Metals and Miners

Credit: Metals and Miners

Simply put, you need silver to make solar panels work. The solar panels industry accounts for 15 to 20% of all silver demand. But that’s not the kicker.

Samsung has developed a solid-state battery for electric vehicles made with silver. In fact, estimates say that Samsung needs 1 kg of silver per battery.

Samsung needs that silver so badly that it cut a deal with Silver Storm Mining to receive 100 percent of the lead-silver and zinc concentrates produced at the La Parrilla mine over two years.

Simply put, Samsung paid $7 million in advance for all the silver Silver Storm mines for the next two years.

EVs and solar are the key industries grabbing all the silver they can. This is part of the reason spot silver is trading above its futures value. In short, we’ve got a silver squeeze happening.

Monetary Value

Like our good president, I’m going to blame China. But really, the USG does itself no favors.

First, Commerce Secretary Howard Lutnick was on Fox when he enthused over President Trump’s new Federal Reserve chairman:

Credit: WSBGold

Credit: WSBGold

So rate cuts are coming… as far as the eye can see. This is ultra-bullish for commodities like silver and gold, as it drives down the cost of carry. That is, lower rates make it cheaper to own them.

Second, the President himself gave the game away a bit with his possible Housing Emergency:

Credit: Eric Daugherty

Credit: Eric Daugherty

If you listen closely, the President says that housing is an important part of net worth for many people, and he doesn’t want to ruin that. The problem is that house prices should go down to make it affordable. But Trump doesn’t want that. So expect money printing and credit creation to help put houses in the hands of younger people.

Again, that’s massively bullish for metals.

The Chinese know this. That’s why Mr. Slammy’s success rate of smashing the metals on the New York open isn’t what it used to be. They’re exacerbating the squeeze for all it’s worth. Let’s join them.

Wrap Up

We’re at the beginning of the perfect storm for gold and silver. The charts look great. The fundamentals are in our favor. We got too much fiat chasing too few ounces. This is great for our holdings, whether it’s physical gold and silver, ETFs, or the miners.

Stay long or be wrong, my friend.

Have a great week ahead!

Oil Off The Boil

Posted December 24, 2025

By Sean Ring

Swamp, Brains, and the Game

Posted December 19, 2025

By Sean Ring

WTI…WTF?

Posted December 18, 2025

By Sean Ring

Icing The Green New Scam

Posted December 17, 2025

By Sean Ring

8 Things That Will Turbocharge The Gold Price

Posted December 16, 2025

By Jim Rickards