Posted July 01, 2025

By Sean Ring

Dollar Dumps, Everything Pumps

Every month, I publish this monthly asset class report not to predict the future, but to show you exactly where we are right now.

The charts are simple candlesticks, with the 50-day (10-week) and 200-day (40-week) moving averages. At the end, I present a couple of performance charts to illustrate the relative trading positions of traditional asset classes and cryptocurrencies.

If you’re a new subscriber, please email feedback@rudeawakening.info with any questions, comments, or concerns. Our mailbag is lively, and I try to publish reader feedback at least once a month. Enjoy!

Equities and metals shone this past June, but so did bonds and real estate. And there’s one overwhelming reason for it.

The dollar stunk up the joint.

As you'll see shortly, Hillary Clinton's 2016 campaign went down with more grace than the dollar index’s current chart.

The Hildebeast’s then-opponent, The Donald of Queens, The Once and Current King, must be rubbing his hands with glee. The dollar index hit a 96 handle, making the toilet paper known as the euro look like a viable alternative to the dollar.

We’ll have to start worrying about the race to the rate-cutting bottom known as ZIRP (zero interest rate policy) that'll kick in once the EU, UK, and Japan realize they can no longer export to the US at these prices.

Of course, Christine Lagarde, the head of the European Central Bank and often considered the least qualified banker in the world, announced that Europe can deal with a EURUSD rate of 1.20. And of course, traders took it straight to that level because politicians-turned-bankers never, ever learn.

We may be on the cusp of another Everything Rally, so strap yourselves in and enjoy the ride.

Now, let’s get a closer look at the charts.

S&P 500

***NEW MONTHLY CLOSE HIGH OF 6,204.95***

Well, I was wrong, and I hope you stayed long. I wasn’t hopeful that we’d get above the former weekly high of 6,147. The moral of the story is to never bet against Donald Trump. Whenever he says to buy stock, you buy stock. Simple.

The tentative new target is north of 8,300. That doesn’t matter. It’s time to get bullish again, if you weren’t already. The only rug pull I’d be worried about is next week’s Netanyahu visit to the White House. Trump must resist Bibi’s begging to invade the uninvadable Iran. If Trump caves in, it’ll be the death knell for this rally.

Nasdaq Composite

***NEW MONTHLY CLOSING HIGH OF 20,369.73***

Wrong again here. The same story as the SPX, but with higher volatility in the case of the Nazzie. If you can pick the right tech companies, rather than the QQQ, you can dine out on it all summer.

The target remains 26,264.

Russell 2000 (Small caps)

It's the same story here, except there are no new highs. We rallied further in the Russell 2000, but we first need to regain the all-time highs of around 242.50 and then aim for the 264 target that remains from last month.

The US 10-Year Yield

The ten-year yield moved lower last month but remains within its range of 3.90%- 4.80% (excluding Liberation Day’s swan dive).

I’m not a believer in the US economy, so I can see the yield falling further, which would weaken the dollar even more.

There is no target either way at the moment.

Dollar Index

Will the dollar follow the 10-year yield, or break away?

That was last month’s question… and we got our answer. The DX has broken down, and the new price target is a frightening 86.92.

The Donald will be thrilled to hear it!

USG Bonds

Bonds have popped this month, but this trend is likely to be short-lived. With the dollar falling, we expect inflation that will erode the value of long-dated bonds.

The downside target is 76.72.

Investment Grade Bonds

Again, we headed up in LQD. Our significant upside target is 129.70. If we clear the previous highs, we may be able to hit that target.

High Yield Bonds

Junk creeped up another point, but I’m not sure if there’s much left in the HYG to warrant a position at all—no upside targets from here.

Real Estate

VNQ held the ship steady this month, barely moving at all. It now has upside targets, the biggest one at 101.25. But first, it must clear the former highs at 96 so we’re sure it’s heading up.

Energy: West Texas Intermediate (Oil)

After a 12-day war between Israel and Iran, oil is almost back where it started.

I’m still very bearish, for reasons we outlined in yesterday’s Rude.

The downside target is now 52.57.

Base Metals: Copper

Wrong again, here. Dr. Copper popped last month. It looks like we’ve got a new upside target of 5.30. If we hit that, we could be off to the races.

Precious Metals: Gold

***NEW MONTHLY CLOSING HIGH OF 3,304.04***

Despite the bullion bank shenanigans, gold managed to make another new monthly high. We still have a downside target of 3,002, but the likelier path is to the upside. The algos will see this half-year's all-time high and start to buy.

As I write this at 5:30 am ET, gold is already up $40.

Precious Metals: Silver

***NEW MONTHLY CLOSING HIGH OF 36.11***

We got this call right, thank heavens!

We nearly hit the 36.17 target to close the month at 36.11. I’m thrilled, and I think this is the launching point. Silver is already up $0.40 this morning.

We’ve got a downside target of 33.93, but again, I think the likelier path is up from here.

Cryptos: Bitcoin

***NEW MONTHLY CLOSING HIGH OF 106,560.55***

Bitcoin rallied further, but we’ve got a downside target of 88,790. Bitcoin could use a correction, but that seems a little steep.

Cryptos: Ether

Ether was down slightly this month, but there's no cause for concern. Its new upside target is 2,703.

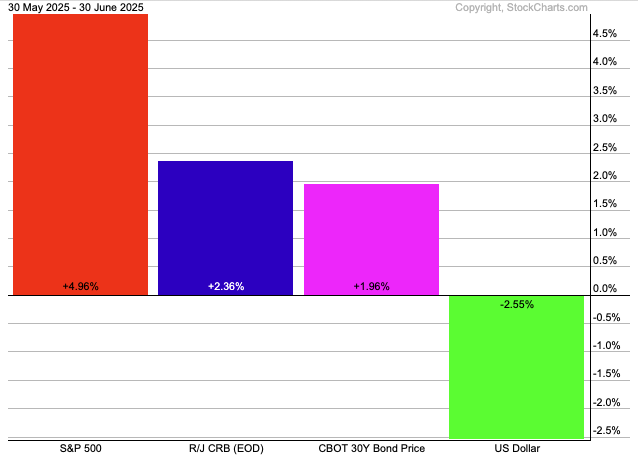

Trad Asset Class Summary

The dollar was the big story this month, falling 2.55%. As a result, the SPX was up 4.96%, while commodities trailed with a return of 2.36%. Even the long bond had a good month, up 1.96%.

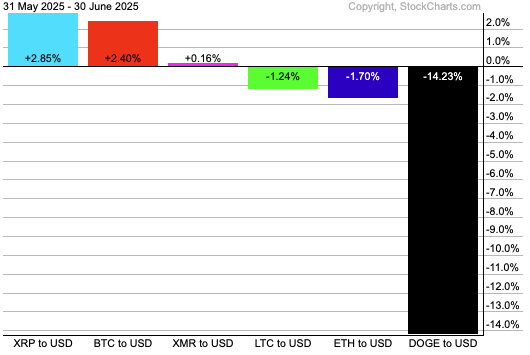

Crypto Class Summary

It was a “meh” month for crypto, as its biggest leaders, Ripple and Bitcoin, only managed gains of just over 2%. Monero was flat, eeking out a 0.16% return. Litecoin and Ether were down by just over 1%. Dogecoin got crushed, down 14.23%.

Wrap Up

The dollar was the loser that made everyone else a winner this month. Equities and metals, especially, had a lot of fun.

Finally, let us laugh, courtesy of the X-verse:

Have a great day!

“That’s A Disgusting Assessment of the Conflict!”

Posted June 30, 2025

By Sean Ring

Oh, Cry Me a Canal!

Posted June 27, 2025

By Sean Ring

“You Better Get A Big Shovel!”

Posted June 26, 2025

By Sean Ring

مرحباً بكم في مدينة نيويورك!

Posted June 25, 2025

By Sean Ring

A Most Cordial War

Posted June 24, 2025

By Sean Ring