Posted January 26, 2026

By Sean Ring

Dollar Detonation

I blinked a couple of times as I looked at my market watchlist this morning. Having already broken $5,100, gold is now trading at a barely more believable $5,095. I guess $5,000 wasn’t much of a psychological level to surmount. Silver, which leaped out of gold’s shadow over the past year, just broke the $109 mark.

We’re getting to the part where things are getting scary and moving quickly.

That’s not to say I’m hitting the sell button anytime soon, especially when our good friend and 2023 Paradigm Shift keynote speaker Rick Rule went public recently. Rick said he sold 80% of his physical silver holdings and redeployed that capital into silver mining stocks. That’s good enough for me to feel comfortable sticking around for a bit longer.

In two days, the Federal Open Market Committee (FOMC) will surely leave rates unchanged at 3.50%-3.75%. But that just means when the President installs a new Fed Chairman in May, cuts will be coming, and pronto. I can’t see The Donald appointing anyone with views contrary to his own.

Let’s face it: agree with him or not, the President’s dollar detonation strategy is working. And when a government is incentivized to cheapen its currency to monetize its debt, it's madness for investors to fight that policy. Going with the flow is the easiest money you’ll ever make.

But let’s clear up one thing first.

The US Isn’t Zimbabwe

While there are many alarmists out there, I don’t see hyperinflation happening to the United States. Now, governments screw up all the time, and inflation could get out of control, but I just don’t see it happening here.

This is a controlled demolition. Yes, prices will rise. Yes, goods and services will increasingly get expensive, especially if wage growth doesn’t keep up. Governments never admit mistakes. They kick cans down the road. That’s what this is—buying enough time for the economy to recover.

Will it work? Time will tell.

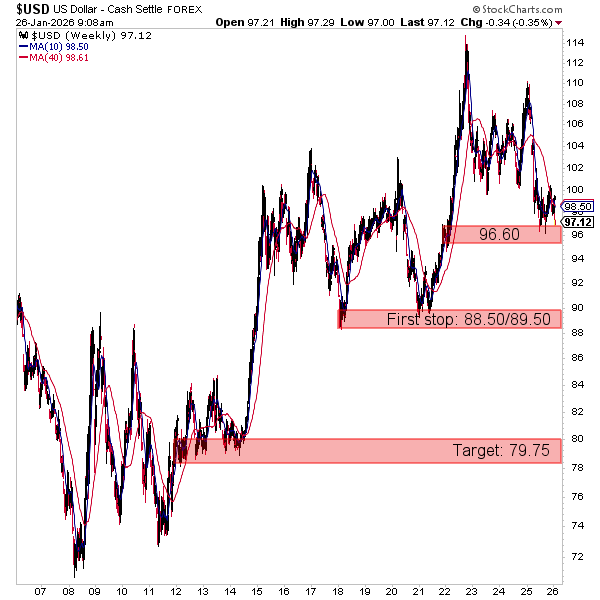

In the meantime, what will likely happen to the dollar? Look at this chart.

The key level of the dollar index we’re approaching is 96.60. Once that level is breached, and it’s only a matter of time, we’ll head to the 88.50/89.50 area pretty quickly. Once there’s been a decisive breach of that level, perhaps after May once the new Fed Head is in office, we’ll meander down to our target of 79.75.

The dollar index is already down 10% year-to-date (ytd). To get to 79.75, the dollar will have to lose another 17.9%.

And that thing where the Japanese 10-year yield is going up while the yen continues to fall? Perfect. It plays right into the USG’s hands. They get to buy yen and sell dollars, all under the guise of helping out an ally stabilize its economy.

SHOW ME THE YEN! The USG has intervened, driving USDJPY down to 153.60.

We’ve got a bunch of fires going on. So, like Charlie Munger would’ve told us, let’s invert. That is, what wouldn’t you invest in?

Bad Bs

US Treasury Bonds

Why on earth would you want to subsidize a $38 trillion-indebted country? Because you have to. There’s no other reason, especially when buying those bonds is a guaranteed loss of purchasing power.

Since 2020, long USTs have lost over 40% of their value. And the President has flat-out told you he’s devaluing the dollar. Why on earth would you stick your money there?

Bitcoin

I wish I listened to my crazy libertarian friends when they told me to invest in Bitcoin at $0.10. I wish I had listened to one of my former grad students who made a fortune in Bitcoin. He told me to buy at $1,000.

Because even if Satoshi Nakamoto turns out to have been an undercover CIA agent who designed Bitcoin as a liquidity sink… even if Bitcoin turns out to be a complete scam… I would be writing this from my very own desert island kingdom, wearing a hula girl as my headdress.

So this isn’t sour grapes. If you made a ton in crypto, you deserve a hearty “Well done!”

But right now, I wouldn’t touch BTC with a barge pole.

As Bitcoin goes, so does most of the crypto space. Avoid bonds and Bitcoin, the Bad Bs.

So what are the alternatives?

The Alternatives

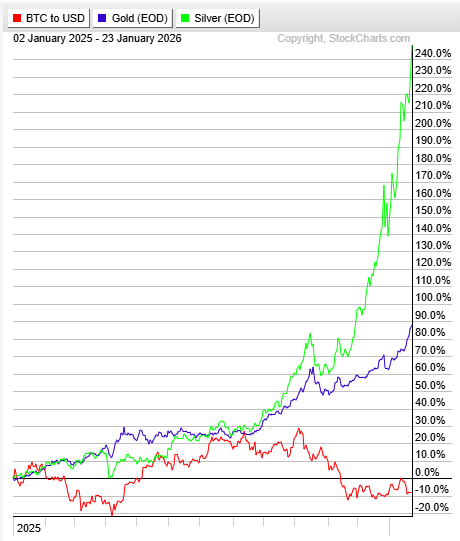

This is the sea change. Those smart kids who piled into Bitcoin to protect their purchasing power now have viable alternatives. They could’ve stuck their cash into the stock market from 2009 until now and done well. But the general stock market isn’t looking that great right now, either.

Could it be they’re liquidating their crypto and buying gold and silver?

Since January 2, 2025, silver has returned 248.57%, and gold returned 87.68%. Bitcoin? It’s returned a negative 7.63%.

Expect more of this in the future. If Bitcoin takes a tumble into the $50,000-$55,000 range, I think it’ll be another boon to the metals. And that’s not considering the supply/demand imbalances, export bans, and tariffs seen in those markets.

But we’re not maximalists. There will be a time to sell metals and our mining positions.

When To Sell?

My friend and colleague Matt Badiali wrote this in the Daily Reckoning last week:

The trick is to recognize when the bull market ends. And that is the key to making money in natural resources. When the trend is up, ignore the noise and ride the wave…because these stocks can go up far higher than you would ever expect.

But when the music stops, you need to get out…immediately. Stock gains are ephemeral. They can go away in an instant. We’ve all seen it. Up one day and then poof, down the next. You must have a way to know when to turn those paper gains into profits.

What was Matt’s solution to this problem?

We used a simple mathematical formula called a trailing stop to tell us when to sell. I generally use a 25% trailing stop.

We didn’t use our “gut” or “intuition”. And we sold our entire portfolio in early 2008 thanks to that trailing stop.

We re-entered mining stocks in early 2009 and made a ton of money because many investors remained on the sidelines.

These are wise words. Let’s appropriate them and put the trailing stop into our toolbox.

Wrap Up

The President is destroying the dollar. Therefore, you’ll need more dollars to buy gold and silver. Gold and silver will continue to rise, maybe with a bump or two along the way. And while the miners have performed, they’re still priced as if gold is trading at $3,500 and silver is at $40.

Let’s let those profits come through.

There will be a time to sell, but that time hasn’t arrived.

Have a great week ahead!

Thank You, Mr. President!

Posted January 28, 2026

By Sean Ring

Bored of Peace?

Posted January 23, 2026

By Sean Ring

NUUK TRUMP TOWER!

Posted January 22, 2026

By Sean Ring

Yen and the Art of Market Maintenance

Posted January 21, 2026

By Sean Ring

From Oil Sheikhs to Mineral Mandarins

Posted January 20, 2026

By Matt Badiali