Posted April 29, 2025

By Sean Ring

Birthright vs. Blackout: Why America Wins and Europe Loses

In a world where some nations seem determined to squander their fortunes, it’s refreshing to see America finally tapping into an extraordinary "birthright" — a $150 trillion treasure trove of mineral wealth that could reshape its financial future. At the same time, Canada's voters, once again, endorsed failure by electing globalist carpetbagger Mark Carney as Prime Minister, while Spain and Portugal plunge deeper into energy darkness, victims of their socialist leaders' ideological blindness and scientific ignorance.

Let's begin with the good news.

America's Hidden Wealth: The $150 Trillion Birthright

Jim Rickards has been sounding the alarm—or, rather, the celebration—that America is sitting on a literal gold mine… as well as a silver mine, an oil field, and a rare earth depository. Far from being broke, America owns a national inheritance so vast, it dwarfs the GDP of most of the world combined.

Recognizing the potential, The Donald signed an executive order to establish America's first-ever sovereign wealth fund, designed to monetize these natural resources on behalf of the American people. Treasury Secretary Scott Bessent's statement — "We’re going to monetize the asset side of the U.S. balance sheet" — marks a revolutionary shift in how America thinks about its wealth.

Rickards' patented strategy promises to allow investors to position themselves ahead of a tidal wave of new wealth. If properly managed, this sovereign wealth fund could rival — or even surpass — Norway's sovereign wealth fund, which was built on its oil wealth, creating massive prosperity for generations of Americans.

This is America at its best: identifying an advantage and capitalizing on it. Not squandering it. Not apologizing for it. Not pretending it doesn't exist.

Contrast that with our neighbors to the north.

Canada's Fourth Liberal Mistake: The Rise of Mark Carney

Canada once had promise, too. Rich in natural resources, with a well-educated populace and strong institutions, it should’ve been a North American powerhouse.

Instead, Canadians just elected the Liberal Party for the fourth consecutive time, this time under the stewardship of Mark Carney, a man whose globalist credentials are impeccable — and, therefore, highly suspect. Carney, a former Governor of both the Bank of Canada and the Bank of England, is a darling of the World Economic Forum crowd. You know, the same crowd that thinks you'll be happy owning nothing and eating ze bugs.

Despite Justin Trudeau's disastrous record —including ballooning national debt, authoritarian COVID policies, suppression of free speech, a deteriorating energy sector, and an affordability crisis — Canadians once again chose the "safe" option. Heck, they even re-elected noted imbecile Chrystia Freeland.

Why? Part inertia, part fear. Many Canadians fear the Conservatives, wrongly convinced they will gut social programs or side with "extremists," both foreign and domestic, like The Donald. The media, mainly in the pocket of Liberal interests, dutifully paints Conservatives as villains. Worse still, Canadians have been trained to prioritize "niceness" and "stability" over results.

Conservative Pierre Poilievre, who’s never had a job outside of politics, didn’t have the fortitude for the battle and folded like a deckchair. It’s incredibly disappointing. All he had to do was point at the Liberals’ record. Instead, he chose to side with them against their would-be Imperial Overlord, Donald J. Trump, to disastrous results. Heck, he lost his own seat!

In this atmosphere, Carney — technocratic, mild-mannered, reassuring to the untrained eye — seems like a "safe pair of hands." But his real agenda? More carbon taxes. More ESG mandates. More central bank digital currencies. More top-down control. Less individual freedom.

As America begins to tap its wealth, Canada doubles down on managerial incompetence.

Spain and Portugal: When Ideology Lights Out Your Country

If you need a real-time example of how bad policy destroys prosperity, look no further than Spain and Portugal.

For years, Spanish socialists and their Portuguese counterparts celebrated their "green energy revolution." They poured billions into wind and solar, crowing about their environmental bona fides at every opportunity. They lectured the world on "sustainability" and "climate justice."

But there was one problem — a rather large one.

Wind and solar power are intermittent. They cannot provide reliable baseload power. Without a dependable backup, such as coal, natural gas, or nuclear power, you get blackouts. Rolling blackouts, a la South Africa, to be precise.

That is precisely what Spain and Portugal are experiencing now.

During periods of low wind and limited sunlight, their energy grids falter. Manufacturing halts. Households sit in darkness. Hospitals scramble for backup generators. What was once a "green miracle" has become a cautionary tale.

Why did they ignore the obvious? Ideology. Spanish socialists were so committed to their environmental vision, they ignored basic engineering reality. They prematurely shut down coal plants and mothballed nuclear facilities, replacing them with energy sources that, by their nature, can’t guarantee a stable supply.

Meanwhile, countries like France, hardly a bastion of right-wing thought, maintained their nuclear energy plants and now enjoy more stable power.

Lessons for America — and Investors

America stands at a crossroads.

It can emulate Canada, electing leaders who talk a good game but deliver stagnation. This poses a significant risk associated with the 2026 mid-term elections. It can follow Spain and Portugal, sacrificing energy security on the altar of ideological purity. If the Democrats ever regain power, this becomes a huge risk.

Or, America can seize its birthright.

By monetizing its minerals, the United States can rebuild its infrastructure, pay down its enormous debt, and usher in a new era of prosperity. Its sovereign wealth fund could become America's "forever fund," ensuring prosperity for all Americans well into the 22nd century.

Of course, this opportunity isn't just for governments. It's also for individual investors.

Today’s upcoming American Wealth Summit, hosted by Jim Rickards, promises to unveil strategies and specific opportunities to benefit from this tectonic shift. We're not just talking about buying some generic energy ETF. We're talking about using sophisticated, patented methods to identify the companies poised to profit first and most.

Wrap Up

In a world that increasingly rewards short-term thinking and virtue signaling, it is rare to find a genuine, long-term opportunity rooted in real wealth.

America has that opportunity now.

Canada chose more of the same: managerial mediocrity dressed up in nice suits.

Spain and Portugal chose fantasy over engineering, and now their citizens pay the price in darkness.

But you, dear reader, can choose differently.

You can recognize America's birthright for what it is: a once-in-a-lifetime chance to create lasting wealth, restore national pride, and secure your financial future.

Don't let the mistakes of others cloud your vision. Seize the day. America is not broke. America is rich — unimaginably rich.

It's time we started acting like it.

❤️🔥HOLY SMOKE! An American Pope!

Posted May 09, 2025

By Sean Ring

The Age of Hephaestus Has Begun

Posted May 08, 2025

By Sean Ring

Fed’s “Stealth” QE Pushed Gold Above $3,400

Posted May 07, 2025

By Sean Ring

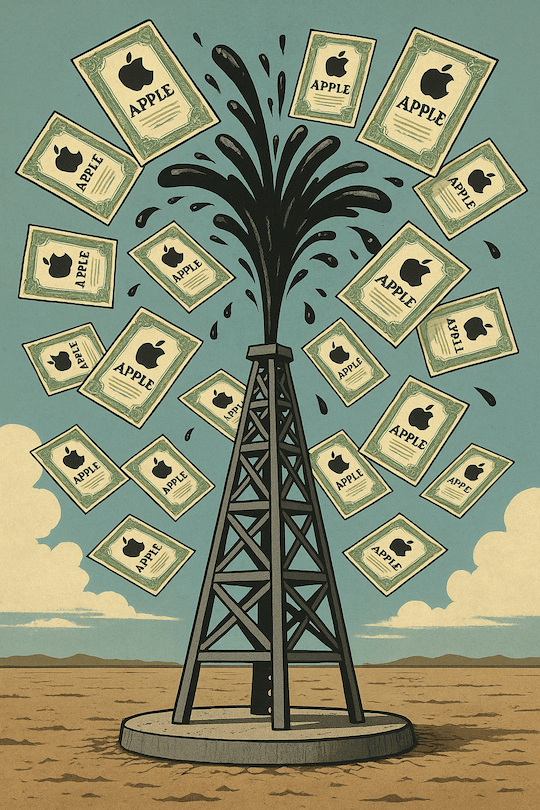

Turning Oil Into Apple

Posted May 06, 2025

By Sean Ring

Goodbye to the GOAT

Posted May 05, 2025

By Sean Ring