Posted October 27, 2025

By Sean Ring

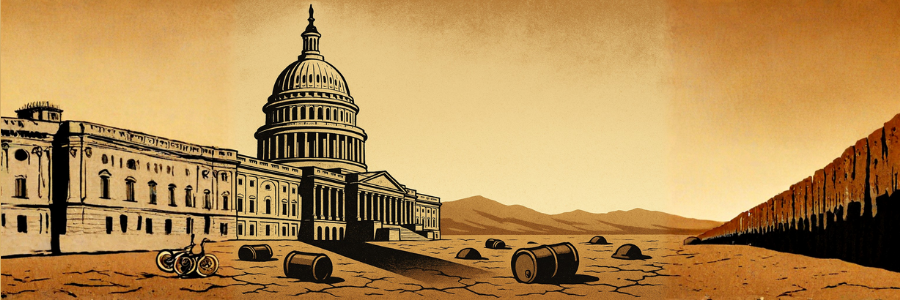

America’s Golden Perimeter: The New Monroe Doctrine

You’re never gonna believe this, but the polls were wrong again!

This time, in Argentina, Javier Milei won the Argentinian midterm elections in a landslide. The papers predicted the diametrically opposite. I still have mixed emotions about Milei. I love his libertarian instincts, but I can’t square them with taking on $20 billion in debt to the U.S.

Nevertheless, the Argentine people have spoken, and good for them.

Bloomberg wrote:

President Javier Milei’s party won Argentina’s midterm vote Sunday, a result that will give the libertarian leader a strong foothold in Congress to continue pursuing aggressive free-market policies that have won praise and a financial lifeline from Donald Trump.

Milei’s party, La Libertad Avanza, received 41% of votes nationwide with 92% of ballots counted, according to data published by Interior Minister Guillermo Francos on Sunday. It led in most of Argentina’s provinces and finished well ahead of the main opposition party, which, in all its iterations, garnered about 32% of the vote, local newspaper Clarín said.

Milei said in a victory speech that he’d have the backing of 101 members of the lower house and 20 senators, without specifying if that total included members of other parties he had partnered with in the vote. The results would push Milei comfortably past the one-third of seats he needs in the 257-member lower house to protect his veto power, as well as a base to pursue legislative priorities like tax, labor, and pension reforms as he seeks to overhaul the nation’s beleaguered economy.

U.S. Treasury Secretary Scott Bessent’s plan to back Argentina has been completely vindicated.

The New Monroe Doctrine

I’ve alluded to the National Defense Strategy that landed on Secretary of Defense Pete Hegseth’s desk last month.

The Strategy is a radical departure from the U.S.’s role as the world’s policeman. It moves U.S. assets much closer to home. This is already playing out. Besides backing Milei, the USG has asserted itself elsewhere in the Western Hemisphere.

- U.S. troops are shoring up cities like Los Angeles and Portland.

- The USG has already been asserting itself more robustly in places like Mexico and Venezuela.

- Tradewise, the USG isn’t putting up with Canada’s yappy nonsense.

While this is done directly on America’s side of the planet, much of it confronts, indirectly, what the USG sees as the Chinese threat. The USG simply won’t tolerate China taking South America’s resources unchallenged.

While in 1823 James Monroe opposed European colonialism in the Western Hemisphere, 200 years later, Donald Trump is reinvigorating that policy in the face of Chinese encroachment.

Now, what does this have to do with gold?

Shelton’s WSJ Op-Ed Piece

Long-time Federal Reserve critic and gold standard advocate Judy Shelton penned an op-ed that The Wall Street Journal actually printed! In “How American Gold Can Shore Up the Dollar,” Shelton praised The Donald’s efforts to save Argentina from its currency. She then noted the most important thing America can do is shore up its own currency.

Shelton wrote:

Fearing currency erosion, many investors are making “debasement trades” by shifting from dollars to hard assets. The Trump administration could counteract this dangerous trend by introducing a U.S. Treasury security offering gold convertibility at maturity. It would be a power move that would throw those nations aspiring to attain global reserve-currency status off their game. In particular, it’s vital that the U.S. one-up China.

She ended her piece by writing:

Given that inflation remains a major concern for Americans, one might reasonably anticipate that this century’s maiden issuance of a long-term U.S. Treasury bond with a gold convertibility feature—say, on July 4, 2026—would be oversubscribed by investors willing to pay a substantial premium. Besides furnishing an inexpensive means of federal government borrowing, it would provide valuable information to the Federal Reserve on expectations of future dollar purchasing power—akin to comparing yields on Treasury inflation-protected securities with conventional Treasury instruments.

If it takes an audit of Fort Knox to verify the gold, so be it. Trust in the American idea requires trust in the American government. What better way to launch America’s new Golden Age?

American power, gold, China… it seems they’re all part of the same game.

What Jim Rickards Wrote About Gold

One of Jim’s Strategic Intelligence subscribers asked him this question: “Should gold investors be worried about the recent drop in price?”

He answered:

No. The price drop has more to do with some profit-taking by investors, which is normal with such a surge in gold in recent months. Also, there was caution in advance of the latest CPI report on inflation that could impact gold prices if a reading came in higher than expected. That didn’t happen. The CPI report showed a 3.0% rate that was lower than expected. This is good news for gold investors. It shows the Fed will continue its rate cutting cycle next week and for the December meeting. These rate cuts will support higher gold prices. Nothing has changed in my analysis of why gold prices have surged. Central bank buying continues, output is flat, and geopolitical risks are still present. Importantly, think of gold as an “everything hedge”. The vectors of uncertainty are everywhere. These include tariffs, tax policy, the War in Ukraine, the rise of China, a likely recession, even left-wing violence. It’s difficult to forecast how any one of these situations will turn out, let alone all of them and their complex interactions. Stocks and bonds can be volatile as a result. Gold is the one safe haven asset that powers through them all and offers investors some peace of mind. I expect the bull market in gold to continue to new highs.

Jim’s position jibes with everything I’ve read over the weekend and what I had come to believe before.

Update to Unofficial Rude Portfolio

After taking the weekend to review the unofficial Rude portfolio, I'm going to take my own advice and remain calm. With that said, I will make the following adjustment.

You may remember a couple of months ago, I sold half of my SBSW holding. With the proceeds, I bought Independence Gold Corp (IGO.V), GR Silver Mining (GRSL.V), and Guanajuato Silver Company Ltd (GSVR.V).

Those stocks are probably good companies, but they’ve performed terribly (down 24%-38%) since I bought them. So I’m cutting them out of my portfolio. I’ll keep the money in cash for now, waiting for a good buying opportunity in either metals or energy.

This may not be my only adjustment. I’ll see how this week goes.

Wrap Up

Between South America, China, and America’s position as the global hegemon, it all points to a gold rally. Silver should follow it up, along with other important industrial metals.

But we’ve just had a colossal smackdown. This resolves either with price or time, so don’t be surprised if we have a prolonged “sideways” move.

Most want America to be strong and free. And while that may seem like common sense, others disagree and will oppose these moves.

The Lakes of Storm and Steel

Posted November 07, 2025

By Byron King

The Start of the Metals Rebound?

Posted November 06, 2025

By Sean Ring

Cheney’s Legacy Is All Around You

Posted November 05, 2025

By Sean Ring

The Socialist Sandbox

Posted November 04, 2025

By Sean Ring

The Joyless Bull

Posted November 03, 2025

By Sean Ring