Posted December 26, 2025

By Byron King

A Copper Melt-Up in 2026, and “Tech” Meltdown

Merry Christmas and Happy New Year!

I hope you had a good 2025… and most likely you did, at least in part if you were invested in the precious metals space. That, along with more than a few other “elements” (so to speak) of the mining sector. Gold-silver-platinum, up-up-up. Copper-lead-zinc, up-up-up. Uranium up. Rare earths up. Antimony up. Tungsten up. Tin up. And more.

Looking ahead, I want to keep rolling with that “up-up-up” thing for you. So, as the new year unfolds, I’ll use my knowledge, skills, and contacts to come up with ways to help you understand the world and make some money along the way.

What’s up for 2026? Hey, glad you asked… In short, we’ll see a melt-up in copper prices and miners, and probably a meltdown in the so-called “tech” sector. It’s important to be in the right spots and avoid the danger zones, so here are some thoughts.

Native copper from Keweenaw Peninsula, Michigan. BWK collection/photo.

Native copper from Keweenaw Peninsula, Michigan. BWK collection/photo.

The Looming Copper Melt-Up

Not long ago, I was on the phone with a friend who has spent many years working in the copper industry. He has skin in the game, with a series of half-billion-dollar (each) copper development projects in Brazil, Peru, and Chile.

“I’m planning on copper at over $12,000 per tonne this year,” he said.

I did some easy math in my head and replied, “So, copper over $6.00 per pound?”

“That’s my target,” he replied. “It’s already over $5.25 and breaking to the upside.”

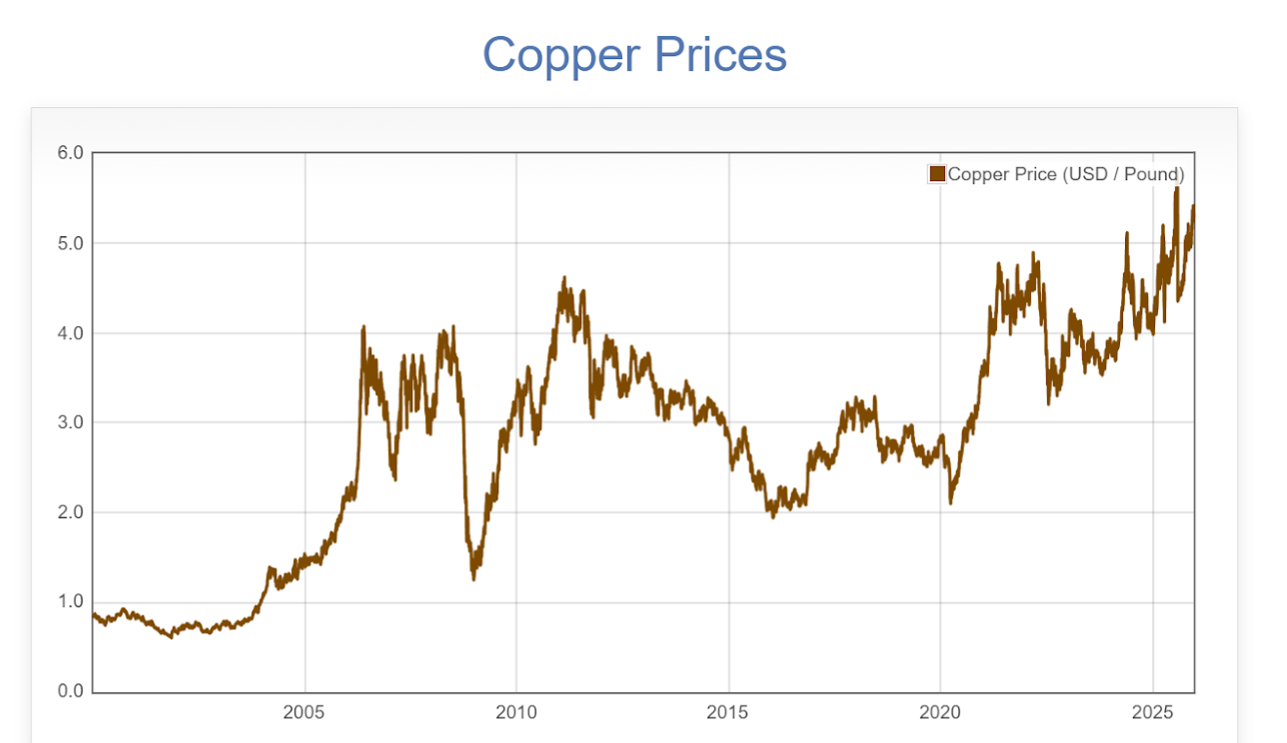

Our talk prompted me to revisit copper’s price chart over the past quarter-century.

The Looming Copper Melt-Up

Not long ago, I was on the phone with a friend who has spent many years working in the copper industry. He has skin in the game, with a series of half-billion-dollar (each) copper development projects in Brazil, Peru, and Chile.

“I’m planning on copper at over $12,000 per tonne this year,” he said.

I did some easy math in my head and replied, “So, copper over $6.00 per pound?”

“That’s my target,” he replied. “It’s already over $5.25 and breaking to the upside.”

Our talk prompted me to revisit copper’s price chart over the past quarter-century.

Copper price, past 25 years. Courtesy DailyMetalPrice.com.

Copper price, past 25 years. Courtesy DailyMetalPrice.com.

Wow, I had almost forgotten that copper traded for under $1.00 per pound early in the 2000s. Even discounting for inflation, that was cheap. Buyers had ample supply from mines that were developed in the 1950s, 60s, and 70s; and overall, there just wasn’t so much demand in those halcyon days before China transformed into its current status as an industrial juggernaut.

Note also the copper price run-up in the mid-2000s, a combination of growing Chinese demand and Western financial speculation that led to the 2008-10 crash.

That crash knocked copper prices down into a $2.00-3.00 trading range throughout the mid-2010s, a time when China’s industrial buildout proceeded apace. All followed by the copper price ascent since 2020, to the current level above $5.25 per pound.

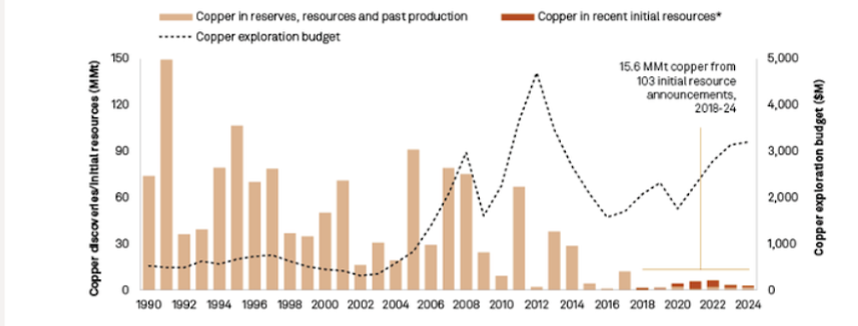

To give a sense of how supply-demand cycles play out over decades-long time frames, here’s a chart of new copper resources added (or not added) over the past 35 years.

Discoveries: fewer, smaller, deeper. Courtesy BHP.

Discoveries: fewer, smaller, deeper. Courtesy BHP.

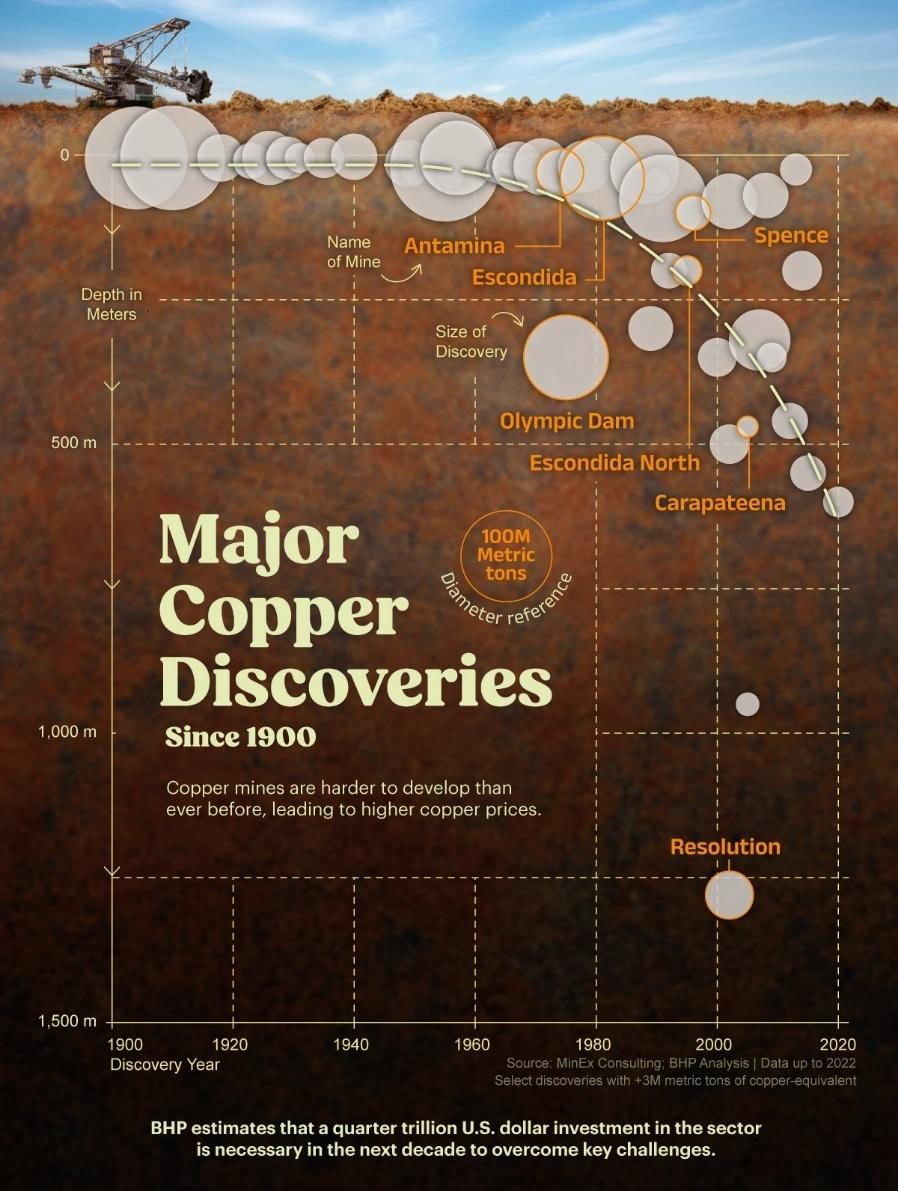

This is geology at work. Copper deposits are a product of deep-earth tectonic and structural forces and mass/energy transfer over geologic periods of time. In other words, there’s nothing “fast” about a copper deposit; it represents millions of years and more of specific forms of geologic and geochemical activity, and what we have today is the finished product. If the copper is there, it’s there; if not, it just ain’t there.

It stands to reason that people long ago figured at least a few things out about copper deposits exposed at the earth’s surface. For example, ancient Egyptians developed copper deposits that they found at the surface in the Eastern Desert; and Native Americans found copper in glacial “float” and rocks around the Keweenaw Peninsula (see photo above). Of course, there are many other examples from archaeology to demonstrate how copper was there, at the surface, and one way or another people learned how to use it.

In fact, there’s solid evidence that copper has been part of human development for over 6,000 years, which is how the Stone Age became the Bronze Age; bronze being an alloy of copper and tin (and in some instances minor amounts of nickel, zinc, manganese, arsenic and/or other elements).

In slightly more recent history, the Industrial Revolution of the 1700s created vastly more demand for copper. Initially, the use was to help utilize steam, such as in pipes, valves, measuring instruments and more. Then in the 1800s people began to use copper to conduct electricity. It makes for a long story, but not here.

The point is that the current arc of global development bends toward billions of people improving their standard of living via electric power, piped water, and all manner of mechanical and electrical systems that require copper. Think of refrigeration, air conditioning, heating and cooking, lighting, and certainly myriad forms of electronics. Yes, copper-copper-copper.

But as those graphics from BHP indicate (see above), it has become more and more difficult to find new deposits of copper. Plus, new-found copper deposits tend to be deeper underground which complicates exploration and development. It all tends and trends toward higher price points to justify copper exploration and development in the first place.

I should add, as well, that most copper deposits don’t just yield copper. In fact, most copper-bearing minerals and ores contain multiple useful elements alloyed with copper or otherwise bound up in the minerals that hold copper. For example, many copper deposits yield silver and gold as byproducts. And/or various quantities of lead, zinc, manganese, tellurium and other elements.

A Copper Idea with Upside for You

Okay, with this background, let’s look at a copper investment idea for 2026.

One great old name is Freeport McMoRan Inc. (FCX), whose copper-mining core is the old Phelps Dodge Co., one of the mining companies that literally built the American West.

FCX shares trade at about $49, giving the company a market cap of about $69 billion. The company operates in the U.S., with numerous mines in Arizona and New Mexico; and also, overseas in Chile and Indonesia, where it has operated the Grasberg Mine for many years.

Earlier this year, a major cave-in and mud flood hit Grasberg, which tragically led to the death of seven employees, and also knocked FCX shares for a loop. By now, though, Freeport has figured out what went wrong, assessed the damage and is repairing the workings. Freeport expects to restart mining at Grasberg early in 2026, which ought to catch the market’s attention.

Meanwhile, copper prices have crept up, as noted above, while the associated gold output from Freeport’s copper mines has also benefited the company. And this brings us to another angle, which is that the gold and silver associated with many of Freeport’s copper deposits is deeply undervalued. Frankly, the market looks at Freeport as a copper pure-play, despite its output of over 750,000 ounces of gold per year, and a gold-equivalent resource of over 30 million ounces.

The bottom line is that, as we kick off into 2026, Freeport is undervalued. Shares are still recovering from the Grasberg accident. The market does not give the company credit for its solid copper portfolio, and there’s not nearly enough respect for the associated gold and silver resource.

Freeport is a buy at current levels, with limited downside. Watch the charts, wait for down days in the market, always use limit prices, and never chase momentum.

The Looming “Tech” Meltdown

For as much promise as metals and mining plays have for 2026, I’m cautious about the so-called “tech” sector. Indeed, I often wonder why this sector has so much respect in the market, let alone why so much investment money still pours into it.

Sure, share prices for tech plays soared over a couple of decades and created small armies of wealthy people and funds. Giants like Amazon, Microsoft, Google, Apple, Facebook/Meta and more have done quite well in terms of revenues, growth, profits and shareholder returns.

Yes, and that was then. But now, as the saying goes, “past performance is not indicative of future results.” In particular, in 2026 quite a few shoddy, shady and even illegal business practices of this sector over the past 20 years will come around and absolutely slam companies and their share prices.

First and foremost, 2026 will be a year of reckoning for many companies’ dangerous, if not outright illegal, reliance on foreign workers, particular visa-holders from overseas who come to the U.S. under the H-1B system, or related alphabet soup programs like OPT, J-1, L-1 and more. Many of these visa players are working under false pretenses, if not fraud against the system.

With H-1B visas, for example, the program was conceived in 1990 under President George H.W. Bush. The idea was to alleviate what some people thought would be a looming worker shortage in the 1990s, and to bring in future Einsteins, Teslas, and Fermis, if not more Werner von Brauns. But over the past three decades, the program transformed into raw, shameless, low-cost, human trafficking intercontinental labor arbitrage.

Right now, over five million Indians hold H-1B visas to work in the U.S.; and over one million Chinese also hold such visas. The excuse we hear from corporate America is that “Americans lack the necessary skills,” which is little more than a facile bromide. Indeed, almost all H-1B visa advertisements are for entry level jobs, meaning that the company must train the new hire.

And NO! It’s not that America is a nation of lazy, entitled, privileged, latte-swilling, couch-potato dummies who “lack skills.” American schools turn out plenty of smart, well-qualified young people in technical and science fields, certainly who “learned to code” as the saying goes.

What’s going on is that American businesses want to hire foreign labor at 40% the cost of an American worker. Businesses want to avoid the salaries, benefits, and taxes that come with domestic workers, and then book the profits to please Wall Street. That is, we’re seeing an old scam playing out again.

By comparison, think back to how American business deindustrialized the nation in the 1980s, 90s and 2000s by shipping manufacturing jobs overseas. These practices created the so-called “Rust Belt” and wrecked much of the social cohesion of entire regions of the country. And hey, how do you think Candidate Trump became President Trump? He touched that raw nerve among voters.

Well now, we have a new generation of “tech” managerial class that has also ripped the guts out of its own job sector by importing cheap, if not sweatshop labor. Certainly, in the past 20 years millions of American workers have lost jobs to foreign workers, plus outsourcing jobs to low-wage nations, mostly India.

U.S. tech companies charge U.S. price levels for their services and products but then turn around and pay third world wages to key parts of the workforce. In fact, much of current Silicon Valley is a sweatshop of foreign visa workers who receive low wages, often pay little or nothing in the way of state and federal taxes, live many to a rundown rental house, collect public benefits like EBT and/or SNAP food supplements, and can’t complain lest they get fired and deported on the next jet to Hyderabad.

Right now – and this is the case even under the Trump administration! – many Americans must compete with visa workers from across the globe just to find a job here in their own country. It’s lunacy, and likely why Trump’s approval rating among Millennial youth has cratered. And it’s why Republicans stand a good chance of being slaughtered at the polls next November absent a full court press to end the visa insanity.

But it’s also clear that this visa game is up. There’s a massive political movement out in the hinterlands to force Congress and the Trump administration to crack down on visa scams, and I expect many tech companies to feel the immediate blowback in 2026. They’ll take hits to the visa workforce, to wage scales, taxes, and big-time litigation.

Already, U.S. embassies overseas are “slow-walking” visa interviews. And closer to home, no less than the U.S. Equal Employment Opportunity Commission (EEOC) is soliciting clients to bring cases against employers for overt discrimination in hiring, the civil rights scandal of our era. Plenty of companies are about to be dragged into court.

Here’s my takeaway: if you’ve made money in tech, great. Just be sure to sell a few shares and move that money off the table. You might even want to redeploy it into hard assets like gold, silver or copper. And if you do that, you’ll be in a better place.

That’s all for now. Thank you for subscribing and reading.

The U.S. Equity Indices and What They Mean

Posted December 30, 2025

By Sean Ring

Bonding Over Christmas

Posted December 25, 2025

By Sean Ring

Oil Off The Boil

Posted December 24, 2025

By Sean Ring

Gold Bars, Up Bars, and FUBAR

Posted December 23, 2025

By Sean Ring

EX-SQUEEZE ME!

Posted December 22, 2025

By Sean Ring